BEAR: The S&P 500 closed in bear market territory yesterday, over 20% down for the year, and history tells us there is still a way to go yet. Recession risks are rising and could see this market fall another 20%. Indeed the average S&P 500 bear market, few and far between, lasts 19 months and sees a 38% drop in prices. This one has only lasted five months and is down 21%. We are invested, for a gradual U-shaped recovery, but defensive, to manage the rising risks.

RECESSION: But a recession is not inevitable. Economic growth is resilient so far, consumers have big savings, and companies are near record profit margins. The market sell-off has been solely valuation driven, taking price/earnings valuations down to near 16x, below 10-year averages. A missing ingredient of a recession has been weaker earnings, which in such times traditionally fall over 20%, but in fact they have risen this year. Companies have not received the recession memo, but are not immune to the gathering storm clouds. This is the key risk.

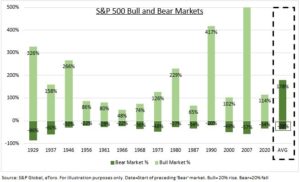

RECOVERY: It’s also worth looking at history to understand the long term balance between risk and reward for investors, with an average US bull market (+20%) surging near 180% and lasting 60 months, four times as long as a typical bear market (see chart). Bull markets are also built off bear markets. These typically remove macro economic and valuation excesses. This is what is happening now, with valuations already down sharply, financial conditions swiftly tightening, and the Fed and other central banks raising interest rates to cut stubbornly high inflation.

All data, figures & charts are valid as of 13/06/2022