HEADWINDS: Oil (OIL) prices survived a quadruple headwind of omicron-demand fears, a strong USD (making it more expensive for foreign buyers), US strategic reserve sales, and increased OPEC+ production. We see these headwinds all easing in 2022, allowing high-for-longer oil prices. Global GDP growth to be twice long-term levels next year. Supply only increasing slowly, on carbon-transition concerns. Oil companies (XLE) will do well even if prices only stay at these levels, with strong cash flows and dividends.

STILL TIGHT: The International Energy Agency (IEA) recently followed OPEC in trimming the demand outlook, given travel restrictions impact on jet fuel. But this was largely offset by strong rebounds in transport and petrochemical demand. They both see only a mild and short-lived impact from omicron. Supply is seen accelerating next year as Russia and Saudi unwind cuts and US rig counts continue recovering. But OPEC spare capacity is likely under-stated and US rig counts still a fraction of prior $70/bbl levels.

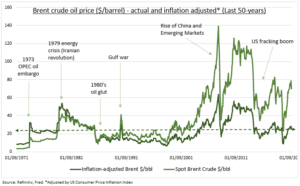

NOT AS IT SEEMS: Higher energy prices have been driving higher inflation in the US and elsewhere. But the impacts should not be overdone. Oil prices have become a lot less important to the economy and markets. Manufacturing is only 12% of GDP. The energy sector 3.5% of the S&P 500. Current oil prices, adjusted for US inflation, are the same levels as 50 years ago. In stark contrast to the spot price which is over three times as high.

All data, figures & charts are valid as of 16/12/2021