FED FOCUS: We are positive 2022, but clear it will see lower returns than last year, with more volatility. The Fed is turning more hawkish. Market is pricing interest rates rising in March. We could see early cuts to its massive $8.7 trillion bond assets. We like cheap and high growth cyclicals, and are cautious ‘defensives’. Healthcare (XLV) is an exception. With cheap valuations, good growth, least bond yield sensitivity, and catalysts.

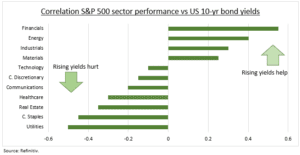

ANATOMY: It’s the 2nd largest US sector, after tech, and 4th globally. Pharma the main component, at 40%, followed by 25% weight on medical equipment (IHI). Medical services and biotech (XBI) follow, at 15% each. The sector has a low 0.6x beta to the S&P 500 and above-average dividend yield. It is time-tested, with 2nd strongest long term average returns, but the lowest correlation to higher bond yields of defensives (see chart).

OFFENCE: Whilst having many attractive defensive qualities, the sector also has clear upside drivers. Endemic covid and mRNA breakthroughs support many big pharma and biotech names. Medical equipment will benefit from more elective surgeries as economies re-open. Secular middle-class growth and demographic drivers remain strong.

EXPOSURE: US dominates the sector, led by UnitedHealth (UNH), Johnson & Johnson (JNJ), and Pfizer (PFE). Some overseas markets are over-represented. Switzerland, with Roche (ROG.ZU) and Novartis (NVS). Denmark’s Novo Nordisk (NVO) and Coloplast (COLO-B.CO). Also see the smart portfolios @Vaccine-Med and @Diabetes-Med.

All data, figures & charts are valid as of 05/01/2022