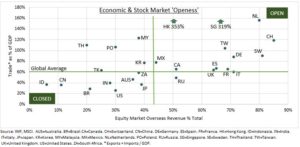

PRESSURE: Global trade volumes are under pressure. Economic growth is slowing, demand rebalancing from goods to services, and trade barriers rising. This is offsetting untangling supply chains. The WTO see’s global trade volumes slowing to 3.5% this year, from 9.1% last, and has slashed 2023’s outlook to 1%. This slowdown may be coming early. Container shipping leader Maersk (MAERSKB.CO) see’s ‘dark clouds on the horizon’ and delivery giant FedEx (FDX) a ‘worldwide recession’. Open goods-focused economies, like Germany, would suffer vs the more ‘closed’ or services-led countries from US and China to Spain and Italy. See @GlobalLogisitics.

OUTLOOK: Global trade volumes fell 0.8% last month. Europe-China container freight rates are the lowest in two years. Dry bulk freight rates are down 35% from highs. Container traffic at the LA/Long Beach port goes one better, now the lowest since the global financial crisis. Demand is easing, but supply chains are also improving. The proportion of global freight stuck on stationary ships is at a two year low of 10%, whilst the Fed’s global supply chain pressure index plunged.

IMPACTS: Yet it’s not all gloom in trade. Services trade is recovering, led by travel and tourism demand. This has room to run as it remains well below 2019 levels. This is all a headwind for goods-heavy and open-economies and stock markets, such as Germany (see chart). Whilst a benefit for those countries weighted towards recovering services, like Spain and Italy. The global heavyweights US and China remain relatively insulated. They both have low trade/GDP, ‘closed’ stock markets, and a economic focus on their consumers – resilient in US but weaker in China.

All data, figures & charts are valid as of 17/11/2022