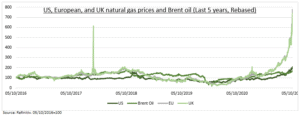

GAS LEADS: Europe’s NatGas prices are +530% this year and US +130%, leading an energy boom with oil +60%, and the broad Bloomberg commodity index +33%. Commodities are in a rare sweet spot of strong demand, as economies reopen, and tight supply, after a decade of price under-performance and under-investment. The carbon transition is disrupting the ‘solution to high prices is high prices’ supply response. US drilling is 75% lower than when oil last $80/bbl.

EUROPE PAIN: Europe’s gas prices have surged, with a combo of adverse weather, North Sea and Russia supply disruption, and competing Asia LNG demand. Industrial users are taking the hit now, but the consumer impact is coming, with gas 40% of UK electricity generation and 25% in Europe. It may get worse, depending on winter weather. Relief is not seen until next year, as seasonal demand falls and supply investments are made. Futures are backwardated (sharply lower).

THE LAST SPIKE: This energy spike adds to a long list of market concerns we see as overdone, and energy is no exception. In 2010-2014 when oil last over $80/bbl, US inflation was 2.1%, bond yields stable, and equities positive. Markets have de-commoditised. Manufacturing is only 12% of the US economy, direct energy 3% of the inflation basket, and energy equities 3.5% of total. Winners are the energy self-sufficient US, Saudi Arabia, Russia, Canada; gas exporters like Shell (RDS.L), Cheniere (LNG), Gazprom (OGZDL.L); and smart portfolio OilWorldWide.

TODAY: Market turnaround as debt-ceiling, to follow government shutdown, in being postponed to year end. See markets to successfully climb the ‘wall-of-worry’ of multiple near-term risks.