RETEST: Markets are retesting year-to-date lows. The dramatic Fed interest rate pivot has driven up bond yields, a sharp valuation derating, rotation from Tech, and now stoking recession fears. Whilst the Ukraine war boosts uncertainty, high-for-longer commodity prices and Europe downturn fears. China’s zero-covid lockdown completes the three-pronged vice on global markets. We are in a new and more difficult investment world, but see the glass as ‘half-full’, and navigate valuation and growth risks with a ‘barbell’ of cheap cyclicals and traditional defensives.

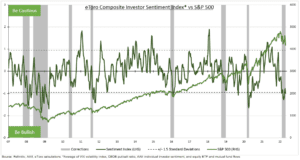

SUPPORTS: It feels bleak, with fear in the driving seat, but we think markets are sensitive to ‘less bad’ news. Recession risks seem early, with GDP above average. Inflation expectations easing from highs. Fed rate hike expectations now dramatic. And Europe and China with policy ‘buffers’. Corporates are a support, beating Q1 earnings expectations, and strongly investing. Technically, the very depressed level of investor sentiment (see chart) is a contrarian support.

WHAT TO DO: Our cheap cyclicals focus helps against the threat of lower valuations. S&P 500 valuations remain over our ‘fair value’ P/E. Whilst traditional defensives, like healthcare (XLV), and styles like high dividend (HDV), help against growth slowdown fears. Hard assets like commodities, are a hedge to inflation and benefit from still tight supply/demand. Commodities and USD are only assets up this year, whilst Value (IWD) seen strong relative outperformance.

All data, figures & charts are valid as of 27/04/2022