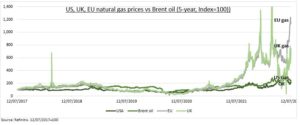

CRISIS: Europe and UK natural gas prices have surged again, confirming the region’s worst energy fears. This is stoking inflation and recession risks, and driving currency weakness. The immediate cause is cuts to the Nord stream gas pipeline that supplies much of Europe’s needs. It is closed for maintenance until July 21st amidst fears it may not reopen. Germany has moved to level II of its gas emergency plan, only one level below rationing. The focus remains on trying to fill gas storage before the winter demand spike. This price surge has left US gas and global oil prices in the dust, a stark reminder of the local nature of gas markets. See @OilWorldWide.

EUROPE: Natural gas provides a quarter of all Europe’s energy. Russia’s share of this has halved to 20% versus last year as LNG imports from the US have surged. Higher prices have boosted major European natgas suppliers like Norway’s Equinor (EQNR), whilst most integrated energy and utilities have been well-protected or benefitted so far. But as prices soar so have the costs. Governments are implementing windfall taxes and wholesale price caps, as they seek to cushion the consumers and industrial sectors who are the biggest gas users. @EuropeEconomy

US: Natgas supplies 32% of US energy and prices (NATGAS, UNG) are 20% off highs, dragged down by oil prices. But prices are double the 5-yr average, with solid US demand in the summer months when cooling accelerates. Also, international LNG demand is high, from Asia and especially Europe. This impacts across the supply chain, from drillers – like EQT Corp. (EQT) – to pipelines – like Enterprise Product Partners (EPD) – and LNG exporters – like Cheniere (LNG).

All data, figures & charts are valid as of 13/07/2022