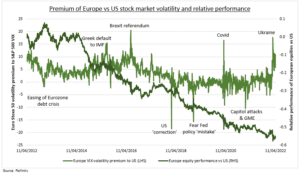

GIVING UP? After outperforming the US earlier this year, Europe ex UK (EZU) equities have slumped under the weight of the Ukraine war and Russia sanctions, high oil prices and surging inflation, and a tightening French election. Equity outflows have soared, even as broader global equities enjoy inflows from the even more stressed bond market. This investor confidence crisis has been worsened by major asset manager stake sales. From Germany’s largest listed banks, Deutsche Bank (DB) and Commerzbank (CBK.DE), to Airbus (AIR.PA) and E.ON (EOAN.DE), and London Stock Exchange (LSEG.L) and Glencore (GLEN.L). Europe’s fundamentals are stressed but secure, and the current volatility spike (see chart) offers opportunities for the brave.

VOLATILITY SPIKE: Euro Stoxx 50 equity volatility index is three times normal levels vs the S&P 500 VIX volatility index. It is always higher, given the less diversified European index, and its more cyclical stock markets. But this level of divergence is rare and often followed by bouts of European outperformance – though masked by its dramatic 10-year slump versus US equities.

OUTLOOK: We believe the European growth outlook is reasonably secure, supported by the near-unique regional buffers of zero-bound interest rates, the competitive Euro, and rising fiscal spending. Regional companies are forecast to report over 25% profits growth this Q1 earnings season, four times that expected in the US, and with P/E valuations 30% lower. For those without the stomach for this, look to Japan, which has a similar fundamental profile but less of the risks.

All data, figures & charts are valid as of 14/04/2022