RECESSION: The UK and Eurozone are set for a recession later this year, with the Bank of England and ECB leading a drumbeat of downbeat forecasts. The only question is how big it will be. This will have global implications for many economies and companies. And comes at a difficult time with US growth also slowing and China’s recovery still stop-start. But Europe’s blow will be softened. By stepped up government spending and a competitiveness boost from weak currencies. And equity valuations, earnings forecasts, and investor allocations are already low.

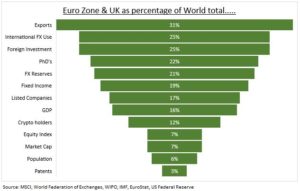

WORLD: Europe and UK are the world’s third largest economy, and one of its largest exporters and investors (see chart). The EU is the top trading partner for 80 countries, versus only 20 for the US, making any slowdown broadly felt. This all dwarfs the relative size of its population, and equity markets. With its 440 million wealthy consumers it is the largest source of overseas sales for US companies, led by Booking (BKNG), Estee Lauder (EL), and Cooper Companies (COO).

EUROPE: Investors have already incorporated much of this gloomy outlook. Both the Euro and equity indices have slumped. Company revenues rebounded a strong 28% in Q2, and 18% excluding energy. These were stronger rates than in the US. But a sharp earnings slowdown is coming, with only 2% growth forecast next year. Though some still have unrealistic double digit expectations, from industrials to retail. Moreover, the 11.0x fwd. P/E valuation is now 15% below average. Though still above the ‘worst-case’ 2008 crisis 7.5x low. The investor underweight of European equities is now over 2 standard deviations below average, per latest BAML survey.

All data, figures & charts are valid as of 14/09/2022