EYE-OF-THE-STORM: Record natgas prices, looming energy rationing, drought, stagflation, recession. Europe is stuck between an economic rock-and-a-hard-place. The energy crisis is intractable, set to drag the continent into a recession later this year, and its impact drag into 2023. The Euro has borne the brunt of this investment storm, whilst equities have been more resilient. Profits are growing off a low base, and valuations already cheap. A weaker euro, still low interest rates, and rising fiscal spending are all important supports. See @EuropeEconomy.

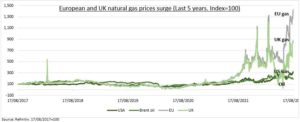

ENERGY CRISIS: EU natgas prices are at all-time-highs (see chart). The continent struggling to fill winter storage. Russia ‘weaponized’ Europe’s gas dependency by slashing exports. Industrial users who’ve seen a c40% rise in overall producer prices have cut demand 20%. This is driving the consumer cost-of-living crisis. The UK energy price cap is to be announced next week and set for another 50%+ surge. This is forcing governments to ramp up fiscal support. Rationing is next on Germany’s emergency plan. Many are praying for a mild winter or Russian forbearance.

SILVER LINING: Europe’s equities have not done as badly as feared, lagging global markets ‘only’ 5% in recent months. They were already cheap. Hardest-hit Germany is at a 45% P/E discount to the US. Half of European sales are from abroad, with the weak Euro providing a competitiveness cushion. Q2 earnings are up 29%, triple the S&P 500 growth, and 7% better than expected. The benefit of a depressed earnings base and low expectations. Economies are not always stock markets. The UK has probably the worst outlook of any big economy, with 13% inflation and a five-quarter recession forecast, but is the best performing big market this year.

All data, figures & charts are valid as of 18/08/2022