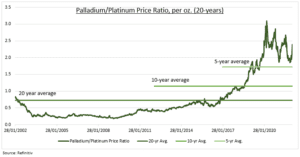

A BETTER YEAR: Platinum group metals (or PGM’s) are having a better start to the year after a miserable 2021, when they missed the commodity rally. The rebound is led by palladiums (PALL) 23% surge. This is driven by sanctions-risks to largest producer Russia -40% of total- and the forecast recovery of the key car market, at 85% of demand. Platinum (PPLT) has also rallied (+7%), on its coattails as a substitute for palladium’s sky-high relative price (see chart). Autos are 35% of platinum demand, alongside jewellery and healthcare. Enjoy the palladium rally now, as the long term outlook seems terminal.

CLOCK TICKING: Palladium’s dominant use is as an oxygenation catalyst in catalytic converters. It turns 90% of an engine’s pollutants into CO2 or water. In the short term the market will be in a deficit, helping prices, as demand grows c20% this year. 1) Global auto production rebounds 10% this year, as chip shortages ease. 2) Tighter emission controls will boost palladium loads in catalytic converters. 3) It is used in hybrid electric vehicles (EV) which are c30% the global EV market today. But long term the substitution risk from pure-play EV’s, that need no palladium, could be a terminal price overhang.

STOCKS: Potential Russia sanctions disruption is likely overdone? Commodities are fungible, can be sold anywhere, and Russia is the dominant producer of this critical metal. The next biggest is South Africa (38%). Main producers are Russia’s Norilsk Nickel (MNODL.L), and South Africa’s Sibanye (SBSW) and Anglo American (AAL.L).

All data, figures & charts are valid as of 03/02/2022