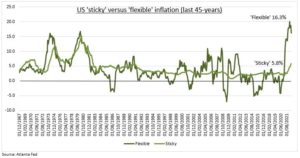

PEAK: After a string of negative monthly US inflation surprises the fifth was the charm. This positively surprised across-the-board and validates the rally from June lows. Markets remain supported by now-peaked inflation, resilient corporates and consumers, and still depressed investor sentiment. This helps make them geared to any less-bad news. There will be bumps in the inflation road. Heavily-weighted ‘sticky’ inflation is still rising (see chart) as labour and housing prices are strong. But investors have now seen the top of the key inflation mountain.

VALIDATION: The July inflation numbers beat forecasts across the board, both headline and core, and year-over-year and month-over-month. This validated the recent commodity and supply chain lead indicators, the sharp markets relief rally since the June lows, and will now give food-for-thought to the ‘data-dependent’ Fed ahead of the September 21 meeting. Markets now price a more dovish 0.50% pace, and a December peak. The relief rally has been led by the most depressed, from crypto to technology and broader US equities. This likely continues.

U-SHAPED: We think the bear market bottom has been seen and the now slowly improving inflation visibility drives all else, from a more benign US Fed to lower recession risks. This justifies some additional risk-taking by still very cautious investors. But we think this remains a U-shaped recovery, with inevitable fits and starts, and needs healthy dose of defensive stocks. The earnings growth outlook is full, P/E valuations back over average, and Fed not happy financial conditions are loosening. This sets up a possible August 25 Jackson Hole showdown.

All data, figures & charts are valid as of 10/08/2022