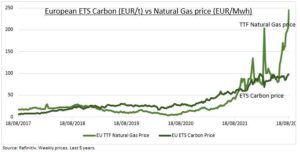

CREDITS: Carbon allowance (EUA) prices in the European Union emissions trading scheme (ETS) soared near 30% in a month. These CarbonEmissions briefly traded over the symbolic EUR100/tonne for the first time ever. This also boosted the KraneShares Global Carbon ETF (KRBN), which is 63% invested in the EU scheme. This has been driven by soaring local natural gas prices (see chart). This pushed more utilities to switch generation to carbon-heavier coal. Which has resulted in higher emissions and demand for permits. The longer term ETS market development, and price outlook, is clear. But we see room for some caution in the short term.

CAUTION: High ETS prices may be curbed by 1) lower industrial production and allowance demand as recession looms. Or even sale of surplus allowances from shutdown businesses. 2) The return of full EUA auction volumes after their seasonal 50% August fall. 3) A stabilization of gas generation demand as winter storage targets are met. 4) Overhang of a sale of €20 billion allowances under RePowerEU plan. This funds the cutting of energy dependence on Russia.

DEVELOPMENT: EU leads the world in developing its carbon pricing market. Plans are afoot to 1) expand the system to new sectors, like shipping. 2) Raise the emissions reduction target to over 60%. 3) Introduce a border adjustment tax, effectively globalizing Europe’s carbon price. A deal is possible here by the next CO27 conference, in Egypt, November 6-18. Meanwhile, the world’s biggest (three times the EU scheme) and newest carbon market, in China, is set to expand. To add heavy industry and manufacturing sectors to the scheme launched last year.

All data, figures & charts are valid as of 22/08/2022