HIGH STAKES: European Central Bank (ECB) is close to raising interest rates for first time in a decade as it faces a yawning disconnect of 8% inflation and -0.5% rates. This is riskier than it seems, and likely means less-hikes than expected. 1) Europe is closer to recession than most, 2) supply-side inflation more intractable, 3) ECB’ $9.3 trillion balance sheet bigger and equals 66% GDP, and 4) fragmentation risk is high, with widely different national debt and bond yield levels.

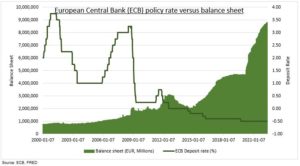

EXPECTATIONS: The ECB is set to start shrinking its mammoth balance sheet (see chart), and starting to hike interest rates at the July 21 meet, by an expected 0.25% a meeting, towards its ‘neutral’ rate around 1.5%. The lack of an equivalent to the Fed ‘dot plot’ guidance makes this plan unclear. We do not think it will get that high, given the multiple constraints above plus the big rise already seen in bond yields. Memories of the two hike 2011 ECB flip-flop are still fresh.

IMPACTS: Europe is behind US cycle, with inflation peaking only this summer, and rate hikes lagging. Following through on hiking expectations, along with already higher 10-yr bond yields, helps support the EUR for now. These higher bond yields and avoidance of recession would help long-suffering banks, Europe’ (EZU, @EuropeEconomy) largest sector. A curbed hiking cycle, and still supportive financial conditions, would help indebted sectors, like utilities (XS6R.L), and more-indebted ‘peripheral’ economies like Italy and Spain (ESP35) with 100%+ debt/GDP.

All data, figures & charts are valid as of 07/06/2022