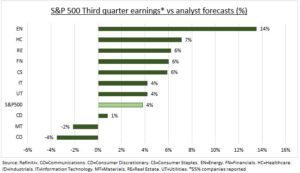

GROUNDHOG DAY: We are seeing a July earnings season repeat. Less-bad-than-feared S&P 500 third quarter profits are a relief to investors. Europe’s are even stronger. This buys investors time until a Christmas Fed interest rate slowdown. Profits will keep easing but be crucially offset by less valuation pressure. Markets were braced for under the 2% profits and 9% sales growth reported. Forecasts were slashed in advance, and valuations 15% under average. Markets are now rewarding ‘beats’ more than they are punishing ‘misses’, and shrugging off tech weakness.

THIRD QUARTER: Over half of S&P 500 companies have reported third quarter earnings. 70% have beaten the low earnings and revenues expectations bar set into the quarter (see below). The energy sector is carrying the market, without which earnings would be in a recession, down 5%. Net profit margins have fallen to 12% but are still above average even as cost pressures bite. Domestic-focused US stocks are leading profits resilience as stronger dollar takes its toll. 2022 management guidance is firm, and balanced between ‘positive’ and ‘negative’ changes.

BIG TECH: Energy has been the sector surprise and ‘big tech’ the disappointment. With earnings and/or guidance weakness from Amazon (AMZN) to Alphabet (GOOG) and Microsoft (MSFT) to Meta (META). Only Apple (AAPL) reassured investors. Exxon (XOM) led the energy surprise, making nearly as much profit as Apple, despite only a fifth of the market cap. Only Amazon saw revenue growth above the S&P 500 average. These stocks are still 20% the index and dominate IT (50% of sector), Communications (40%), and Consumer discretionary (30%).

All data, figures & charts are valid as of 31/10/2022