SLUMP: Copper prices have plunged by a third from their March high, twice the broader commodity fall, under the weight of surging recession fears, a struggling Chinese recovery, and the US dollar rally. Copper’s ubiquitous uses from construction to the green transition makes this the ‘canary-in-the-coalmine’ for slowing global growth, and signals lower US bond yields ahead. But the long-term outlook remains rosy, and entry points more attractive the closer prices get to marginal cost of production around 2.50/lb, with copper stocks overshooting on downside.

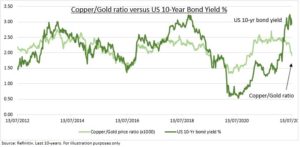

SHORT TERM: The copper slump is sending a firm signal that recession risks are trumping inflation. The copper/gold ratio (see chart) shows clear downside risk to US 10-year bond yields, and support for renewed bond interest. Known as ‘Dr. Copper’ for its ‘Ph.D.’ in economics given the breadth of its uses from electrical equipment (32% of total), to building construction (28%), and infrastructure (16%). The price fall had a disproportionate impact on large copper producers like Freeport-McMoRan (FCX), Southern Copper (SCCO), and Antofagasta PLC (ANTO.L).

LONG TERM: Copper prices are down but far from out. It is central to the long term carbon transition, with its unique combination of high conductivity and relatively low cost. EV’s use around 4x the copper of ICE cars, whilst fast chargers 8kg. each, for example. Additionally, as emerging markets develop usage disproportionately grows. Whilst supply remains constrained by falling mine grades and increasing difficulty of bringing on significant new production. 40% of global production comes from Chile and Peru, whilst 75% consumption from Asia, led by China.

All data, figures & charts are valid as of 18/07/2022