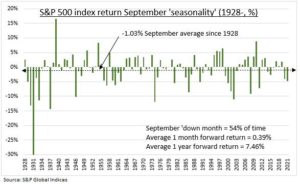

SEASONALITY: September has famously seen the worst S&P 500 returns of the year. These average a -1.0% fall since 1928 (see chart), with a ‘down’ month 54% of the time. This is hardly overwhelming but does add to an already cautious market narrative. Yet, nothing about this year has been average. So we don’t think seasonality should be either. More determinant to our glass-half-full view will be the hopefully cooling September labour market and inflation data and outlook for a less aggressive Fed. For those still unconvinced on the fundamentals, September is traditionally followed by a +0.4% positive October and a +7.5% average 1-year forward return.

DRIVERS: The drivers of September’ weak seasonality range from the end of summer to tax loss harvesting, and back-to-school expenses drag. 1) End of summer ‘return to reality’. Around 85% of global assets under management are in the northern hemisphere. 2) US mutual fund tax loss harvesting ahead of December distributions. With $15 trillion of assets in US equity mutual funds, still over double that in equity ETFs. 3) Back-to-school and college expenses average $1,000 per US household, equal to Christmas as the most expensive consumer event of year.

IRRELEVANT: We don’t completely discount the seasonality. But do think the better known it has become the more it is likely discounted or anticipated by investors. Sentiment indicators are already cautious. Similarly, this has been far from an ‘average’ year so far, with double-digit equity losses and Fed still hiking interest rates after two quarters of negative GDP growth and with inflation at 8.5%. More important will be the key upcoming data of the August jobs report (2 September), August CPI inflation (13 September) and the next Fed meeting (21 September).

All data, figures & charts are valid as of 30/08/2022