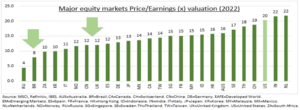

REBOUND: Many of the worst performing markets of 2021 are now leading this year, like Brazil, UK, China. This is similar to the US ‘Dogs of the Dow’ approach of buying the cheapest and often worst-performing and most out-of-favour assets of the prior year. We are bullish many these cheaper (see chart) and often more-cyclical overseas markets.

BRAZIL: The Central Bank has aggressively moved to hike interest rates to contain double-digit inflation. Last week’s 1.5% rise to 10.75% rate was only the latest. This has driven a 5% gain of the still-cheap BRL this year. The equity market (EWZ) is also supported by high commodity prices and is the world’ 2nd cheapest. The cloud on horizon is October’s polarized election, with leftist former President Lula leading in the polls.

CHINA: It’s central bank is the only one globally to be cutting interest rates, to defend a weakening economy, and with room to do more. Whilst the political focus is on stability ahead of the November party Congress. The stock market (MCHI) aggressively derated last year, and remains very under-owned and out-of-favour amongst foreign investors.

UK: The market (ISF.L) benefits from one of the world’s cheapest valuations, including a 3.5% dividend yield. It is seeing one of the biggest earnings rebounds, with Q4 earnings up 200%. This is driven by the sharp economic rebound and deep-cyclical index of banks and commodities. A still competitive GBP helps the high proportion of overseas sales.

All data, figures & charts are valid as of 08/02/2022