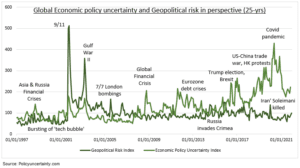

TENSIONS: Russia-Ukraine tensions are stoking geopolitical concerns and adding to the risk-off tone in global markets. These should not be overdone. Geopolitical risk (see chart) is low, relative to the 2000’s Iraq War and 9/11 attacks. History shows limited long lasting global market impacts from most geopolitical crises. Also, broader economic policy uncertainty is already high, and a ‘new normal’. This saps the economic growth and capex outlook, delays decision making, and cuts capital to emerging markets (EEM).

IMPACT: Geopolitical threats often have more impact than the event itself, that resolves uncertainty. Major events are rare, like the 1990 Gulf war or 9/11. Each saw risk assets, like equities, weaken and havens, like gold and US treasuries, outperform. But risk assets quickly recovered. The 2014 Crimea invasion even saw them outperform safer havens. Impacts are greater, and longer lasting, in markets closer to the event. Russia (RSX) is the worst performing market this year, down 16%. This shows even the world’s cheapest market (5.3x P/E ratio) can get cheaper. Conflict could worsen Europe’s (EZU) energy crisis, and boost oil (OIL). Russia is the world’s largest oil producer and wheat exporter.

INDICES: The economic policy uncertainty index is created from ‘uncertainty’ mentions in leading news media of 21 economies, weighted by GDP. The geopolitical risk index was developed by the Fed from ‘geopolitical’ mentions in 10 leading global news media.

All data, figures & charts are valid as of 25/01/2022