FED OBSESSED: We are all obsessed by the Fed. When will they start to taper their massive $8.5 trillion balance sheet? When will they start to raise the world’s most important policy interest rate, and by how much? These expectations have shifted significantly recently, with futures now pricing an earlier mid-2022 interest rate lift off. This market repricing has cut the risk of an eventual negative surprise. Our analysis shows that when rate hikes come, equities often respond with relief (see chart). We see only a modest US interest rate cycle by historical standards. This means only modestly lower equity valuations ahead. The S&P 500 P/E has fallen a lot already and deserves to stay above average with a high tech weighting and low bond yields.

HIKES ALREADY: The ‘big 3’ global central banks in US, Europe, and Japan are still on hold, but the monetary policy winds are turning. Over 28 central banks have hiked this year, a total of 67 times. This compares to only 9 rate cuts. This is the reverse of last year, with a total 207 rate cuts and only 9 rate hikes. Of the biggest central banks, the UK is closest to a hike, by year end.

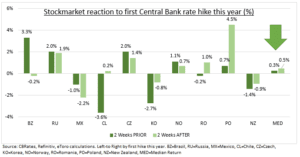

THE TOP-10: We looked at ten of the most significant first rate hikes this year, from Brazil to New Zealand, to see how equities responded. The median local market was positive, both immediately before, and especially, after the first hike. This shows investors had already discounted the rate hike. They may also reward policy makers for seeking to control inflation.

TODAY: UK inflation in focus, estimated +3.2% versus last year, the highest in nine years, as the Bank of England prepares to become the first of the top-5 central banks to hike interest rates.

All data, figures & charts are valid as of 19/10/2021