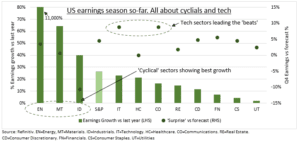

THE GOOD: We are half-way through a good fourth quarter S&P 500 earnings. 77% of companies have beaten forecasts, with 26% earnings growth versus last year, 5 points better than expected. European earnings are not as far along, but even stronger. This is helping international US companies. The best growth is from ‘cyclicals’ (see chart), like commodities and industrials, who are most levered to the strong GDP rebound. Tech is reminding of its earnings power, despite some misses. With some of the stronger growth and highest forecast ‘beats’. See Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL).

THE BAD: The degree of ‘beats’ is lower than prior quarters. This is natural as recovery ages. You cannot surprise analysts every quarter to the same degree. Guidance from some, such as JP Morgan (JPM), Netflix (NFLX), and Meta (FB) has stoked inflation and competition fears. Net profit margins are seeing some pressure but, at 12%, are well above average. Tech is even growing margins further, to 26%. Industrials have borne the brunt of supply disruptions and is the one sector missing forecasts, led by Boeing (BA).

THE OUTLOOK: Q1 forecasts are under pressure, in-line with the omicron slowdown. The Fed’ Q1 GDP NOWCast is 0% growth. But earnings estimates are being raised later in the year. A robust earnings season is a key offset to a hawkish Fed’ downward pressure on valuations, and a reminder of the too low 8% 2022 earnings growth bar. We focus on cheaper and faster growing cyclicals and overseas markets, plus all-weather ‘big-tech’.

All data, figures & charts are valid as of 03/02/2022