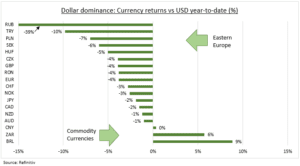

PROXIMITY HURTS: The closer currencies to Ukraine the more painful. Poland’ zloty (PLN) 3rd worst performer this year, -7% vs USD, behind Russian ruble (RUB) and Turkish lira (TRY). Hungary’s forint (HUF), Czech koruna (CZK), Romanian Leu (RON) are not far behind. We see fundamentals stressed but secure. They have been aggressively raising rates to combat inflation. Rates average 3.5% across the four vs ECB’s 0%. This is a FX anchor. The region has buffers to the coming slowdown. GDP growth across the four averages a high 5% today. A weaker FX will also boost export competitiveness. Whilst Defence and refugee spending will support growth.

REST OF EUROPE: Euro (EUR) and Swedish krona (SEK) have also been weak, benefit from these growth buffers, but have dovish central banks anchored at 0%. British pound (GBP) is helped by the hawkish BoE, readying to hike for 3rd time in three meetings. Switzerland (CHF) is a safer-haven with low inflation but the SNB’s tolerance for franc strength is not unlimited.

DOLLAR RALLY: USD rally broadened as Fed rate outlook soared, ahead of Wednesday’s lift off. It further benefited from risk-off mood. Barring a Ukraine de-escalation this continues. It is a headwind to emerging markets, commodities, and US tech. The Japanese Yen (JPY) benefits as a safer-haven, but is undermined by world’s most dovish Central Bank and negative commodities exposure. Commodity currencies, from Brazil (BRL), Australia (AUD), and New Zealand (NZD) have been outperformers on surging prices. China’s CNY also benefited as a safer-haven but authorities are now acting to weaken, to protect the economy in face of rising lockdown impacts.

All data, figures & charts are valid as of 14/03/2022