CHANGE: The latest ‘crypto winter’ has started to ease, after the asset class market cap fell -70% from November. Crypto has since become the $1.1 trillion asset-of-choice leading the rebound in the $110 trillion equity asset class, as inflation and Fed fears peaked. Whilst crypto also tries to put its recent self-inflicted wounds behind it with a successful Ethereum merge on September 15th. Much has changed since the last 2017-18 crypto winter and recovery, or even the 2021 rally. The equity market correlation is much higher, more crypto-equity instruments available, institutional and retail adoption has been transformed, and regulations more developed.

DIFFERENCES: We see four main differences today. 1) The increased crypto correlation with equities, and especially tech, with much of this structural as the asset class has institutionalized. 2) The secular move of traditional finance (’TradFi’) into crypto, with Blackrock (BLK) and Abrdn (ABDN.L) the most recent, following likes of Fidelity to Goldman Sachs (GS). 3) Better understanding of the range of crypto-exposed equities, from miners and MicroStrategy (MSTR) to banks Silvergate (SI), and Signature (SBNY), plus the new bitcoin futures ETFs. Our @BitcoinWorldWide proxy for crypto equity value chain has rebounded 25% off its recent low.

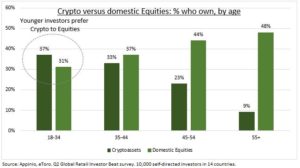

RETAIL: 4) To younger DIY investors preferring crypto over equities, per our Retail Investor Beat survey. This reflects their naturally higher risk tolerance, and tech-savvy. But is a big change versus prior generations and hugely relevant, with earnings power not typically peaking until mid 40’s. The survey also showed 39% buying around the Q2 ‘low’ vs only 12% selling.

All data, figures & charts are valid as of 17/08/2022