WHO’ RIGHT: Financial conditions are tightening, equity valuations falling, and markets near -20% ‘bear’ territory. IPOs plunged and only focused on Value stocks. Yet managements have not received the crisis memo. Earnings and capex are rising double digits, and companies flexing cash flows and balance sheets on acquisitions. M&A is resilient and tech the focus. Reinforces that is a valuation-led correction, with fundamentals still secure, and managements confident.

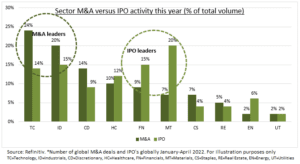

CONFIDENT: Companies are continuing big mergers and acquisitions (M&A), in the latest sign of robust confidence in the fundamental outlook. Volumes are off only 23% this year, vs a record 2021, and tech still dominates (24% total). This week alone saw industrial property Prologis (PLD) $24bn bid for Duke Realty (DUK); tobacco Phillip Morris (PM) $16bn offer for Swedish Match (SWMA.ST); Pfizer (PFE) $12bn offer for Biohaven (BHVN) – see new @Cancer-Med portfolio – and DigitalBridge (DBRG) $11bn data centre buy of Switch (SWCH).

VALUE: By contrast plunging markets have dried up public offerings, with global volume -40% and value -60% this year vs the prior four. Recent IPOs have performed poorly, with the Renaissance US IPO index down 50% this year, and its international version -30%. Activity has been dominated by Value sectors like materials (20% total raised) and financials (15%), with tech relegated to 4th (14%) place. This is similar to the big equity market Value rotation this year.

All data, figures & charts are valid as of 12/05/2022