CONGRESS: The five-yearly Communist Party Congress starts October 16. This 20th Congress is set to give President Xi an unprecedented third term and lay out their future policy plans. It comes at a key time. China’s stop-start covid recovery is at risk, and geopolitical tensions high. The US and Europe are sliding towards a recession. The last Congress led moves to de-risk the economy, slow growth, and embrace ‘common prosperity’. This was hard for many. Hopes are for a pro-growth policy tilt to stabilize the outlook, and support Europe to Japan to commodities.

OUTLOOK: Big policy changes are unlikely and the broad macro contours set to stay in place. Focus will be on the changing membership of the seven-member politburo standing committee and room for a modest growth-oriented economic pivot. China continues to have greater control over its fortunes than most. With its self-imposed zero covid strategy, low inflation, positive real interest rates, and fiscal flexibility. But it also faces unique policy challenges, from its oversized property sector to its demographic headwinds and the slowing of global goods demand. China provided a third of the world’s economic growth in recent years, making its slowdown to a three decade low rate jarring. But even this GDP growth pace is still a multiple of the developed world.

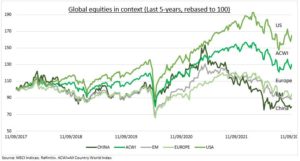

MARKET: China’s domestic focused stock market is the world’s second biggest. Among the cheapest. And fallen out of favour. Local equities (MCHI) had a tough five years, lagging other major regions (see chart). Among other causes, the unwinding tech rally (KWEB) and boosted sector regulations. But China’s equities have done better recently. As regulatory intensity eased, an ADR delisting deal done, and authorities bucked the global trend and eased monetary policy.

All data, figures & charts are valid as of 21/09/2022