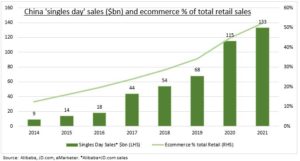

ALL EYES: China’s 11.11 ‘Singles Day’ looms. What started as a small anti-Valentines Day has grown into the world’s largest shopping event. With spending over $130 billion it is now many times bigger than any big US shopping day. This year is set for a spending slowdown, and will be a test on many fronts. 1) For the slow catch up of China’s lagging consumer. 2) To how high online spending penetration can go. 3) And for its struggling tech giants and stock market. It also comes with debate over a possible gradual loosening of China’s unique zero covid strategy.

CONSUMER: 34% consumers plan to spend less this Singles Day vs 24% more. Confidence is hurt by the zero covid strategy and big real estate downturn. Growth will slow from last year’s 15% but sales may still break 1 trillion RMB. Private consumption accounts for only half of China GDP vs 70% in the US, keeping its economic recovery unbalanced. But China dominates global online sales, closing in on a vast $3 trillion annually. Online accounts for 50% of all retail sales, according to eMarketer. The UK is the next closest at a distant 35% and US way back at 15%.

ONLINE: Alibaba (BABA) and JD.com (JD.US) remain two biggest Singles Day players. Even as the Day has evolved and regulatory and competition pressures mounted. It has increasingly become a multi-day sales event. Membership programs and brand building have become more important. New tech has been introduced, from live streaming to virtual shopping experiences. Competition has stepped up, from Vipshop (VIPS) to Amazon (AMZN). 37% of consumers are now looking to shop across five or more platforms. See @ShoppingCart and @ChinaTech.

All data, figures & charts are valid as of 09/11/2022