BETTER START: The Chinese equity stars are re-aligning, after a tough 2021. Interest rates are being cut, policy makers refocusing on stability, and the market better priced. Valuations are half the US, with twice the profits growth, and an as big tech sector. The country remains dramatically under-owned versus its size. A recovering China helps many, like emerging markets (EEM), with China 1/3 the index. EM is also helped by a stabilizing dollar and higher commodities – but a tightening Fed is a big headwind.

DRIVERS: China has begun to cut interest rates, bucking the global tightening trend. This eases risks from the slowing economy and indebted property sector. One year 3.7% interest rates are well above 1.5% inflation, the opposite of globally. The political environment is more focused on stability than sector intervention, ahead of the Winter Olympics and November’s 20th Party Congress. Technically it’s one of biggest shorts in the BofA fund manager survey. An ongoing risk is omicron and the ‘zero-covid’ strategy.

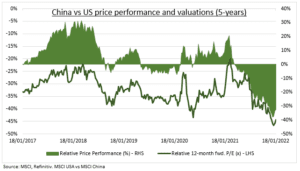

INVESTING: Equities (MCHI) now trade on 12x forward profits forecasts, with financials and property on 5x. This is near half US valuation (see chart), with China forecast to have twice the earnings growth, at 14%. This does not reflect the Value focus of many international markets. China’s listed tech sector (CQQQ) is even bigger than the US, at 55% of the index. Investor focus will likely be on local China (ASHR) or Hong Kong (EWH) shares rather than US ADRs (KWEB). A China recovery will also help related assets like emerging markets (EEM), and the global materials, industrials, and luxury good sectors.

All data, figures & charts are valid as of 20/01/2022