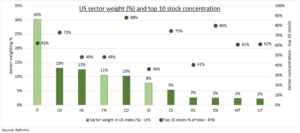

REORGANISATION: Some of the largest tech stocks could be changing sectors in a proposed 2022 reorganisation of GICS*. This could significantly boost the size of the financials and industrials sectors and make IT smaller and stock-concentration worse (see chart). It also highlights the difficulty in classifying many industries, from payments to renewables and cannabis. This has continued to drive the big surge in thematic investing.

IMPACTS: Payment processors Visa (V), Mastercard (MA), Paypal (PYPL) could all leave Tech (XLK) and join Financials (XLF). They would be top-10 stocks, making it 2nd largest sector. It would also make Tech even more concentrated. Apple (AAPL) and Microsoft (MSFT) make up 40% the sector now. Data processors Automatic Data (ADP), Fidelity National (FIS), Paychex (PAYX), Broadridge (BR) could join Industrials (XLI).

WHAT IS *GICS?: Global Industry Classification System (GICS) is the structure for classifying companies into industries and sectors, and underpins much of the $10 trillion exchange traded fund (ETF) industry. This would be only its third big change since 1999 launch, after creating the real estate (2016) and communications (2018) sectors.

TODAY: US producer prices set to ease to 8.6%, now only two points ahead of consumer inflation. This compares to a 17% (!) gap in Europe and 11% in China. Record 13% US corporate profit margins have been able to offset these producer price pressures so far.

All data, figures & charts are valid as of 13/12/2021