HOPE: President Biden gave short-lived deregulation hope to the hard-pressed cannabis sector saying it ‘makes no sense’ for marijuana to have same restriction as heroin under federal law. This was a long-awaited initial step towards federal decriminalization. But is still a long way from untangling the complex patchwork of state laws and conflicting federal law that dramatically raises the sectors production, transport, financing, and tax costs in the world’s largest market. The Alternative Harvest ETF (MJ) is still down 58% this year, and the industry is a tiny fraction of the size and profitability of the related tobacco and alcohol sectors. See @CannabisCare.

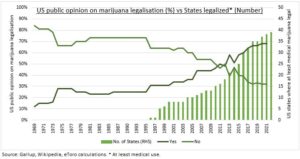

SECTOR: Medical marijuana is now legal in 47 countries and 37 US states. Recreational use is legal in seven, like Canada, Mexico, and South Africa, as well as 19 US states. In the upcoming Nov. 8th US midterm elections votes on recreational cannabis use are being held in five more: Arkansas, Missouri, North and South Dakota, and Maryland. The state liberalization pace has continued to build as public opinion swung firmly in favour (see chart) and states saw the tax revenue opportunities. But Federal decriminalization has been largely stalled until now, despite being a 2020 Biden campaign platform, and faces Republican congressional resistance.

VICES: 16% Americans smoke marijuana. More than the 11% who smoke cigarettes, but a third the 45% who drink alcohol. The capital markets position is very different. The ten largest alcohol and tobacco stocks have $740 billion and $410 billion market caps. This dwarfs cannabis’ $17 billion. The biggest (Curaleaf) grows sales 30%, but with a low 15% gross margin and 2.2% return on assets, and hence low 2.2x price/sales valuation. The largest tobacco stock (Philip Morris) grows sales only 6%, but with huge 66% margin and 24% RoA, supporting 4.4x P/Sales.

All data, figures & charts are valid as of 11/10/2022