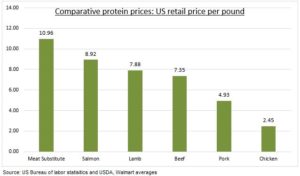

PROTEIN: We all need around two portions, or 50g, of protein a day to stay healthy and keep muscle. The 500 million new global mouths to feed forecast by end of this decade guarantees more protein demand. But it will change. As countries get richer animal protein demand soars up to 20x per person. Whilst in already rich markets meat-substitutes have been gaining ground, partly given their smaller environmental footprint. These long term trends are being temporarily disrupted as the consumers’ cost-of-living crisis drives downtrading to less-pricey proteins (see chart), or cuts. This is helping make traditional protein physical commodities, like cattle and hogs, and related stocks, an investment port to shelter in from the rising recessionary storm.

ANIMAL: Livestock is the smallest (5%) part of the Bloomberg commodity index. It has sat out the broader rally, but is seeing some support from the downtrading consumer. These physical markets are characterized by long feeding periods, and sensitivity to weather and feed prices. Animal feed drives c50% of all grains production. Higher feed and energy prices, and drought, have shrunk herds and supported prices. The largest protein stocks include Tyson (TSN), Hormel (HRL), Brazil Foods (BRFS). LiveCattle is a proxy for beef, and LeanHogs pork prices.

PLANT: Plant-based meat substitutes have had a tougher time, as their higher prices slowed demand from a more cost-conscious consumer. Beyond Meat (BYND) cut its outlook, with similar issues at oat milk maker Oatly (OTLY). But this may be a temporary bump-in-the-road of long-term adoption as prices fall and with current consumption levels tiny. See @Food-Tech.

All data, figures & charts are valid as of 11/08/2022