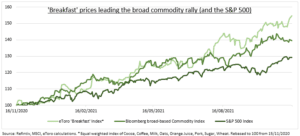

SOFT COMMODITIES: A 55% surge in our ‘breakfast’ cost index the past year is outpacing the commodity rally and piling cost pressures on many. This is boosting inflation, interest rates, and price restrictions in emerging markets (EM) especially, and contributes to our investment caution there. Worse may be to come, with La Nina weather disruption forecast this winter and could impact key southern hemisphere producers. Ag ‘producers’ from Deere (D) to Mosaic (MOS) benefit and ‘users’ like Kraft (KHC) suffer.

‘BREAKFAST INDEX’: Our equal-weight index of eight popular breakfast items, from sugar to wheat, has led the broader commodity rally. Gains the past year have been led by oats (+130%), coffee (70%), wheat and OJ (both 50%) with cocoa (6%) the only laggard.

LA NINA: US Oceanic and Atmospheric Administration (NOAA) is forecasting a 90% chance of a ‘double-dip’ La Nina weather phenomenon, for the second winter in a row. This normally drives dry weather in Argentina and Brazil, two of the largest ag exporters.

INFLATION: The UN (FAO) food price index is at a decade high. Food costs are rising below inflation in developed markets, but well above in EM’s like Brazil, Mexico, Turkey, Russia, South Africa, Indonesia. Food is a bigger proportion of spending and inflation indices, and less processed. 72 of 77 interest rate hikes this year have been EM.

All data, figures & charts are valid as of 16/11/2021