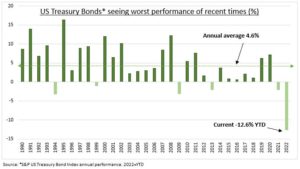

NOWHERE TO HIDE: Only the US dollar and bitcoin rose last quarter, of major assets. This continued sell off in both bonds and equities, the two biggest and most traded liquid assets, has given investors nowhere to hide. The equity sell off has been very painful, but the bond version is historically unprecedented (see chart). The MOVE bond market volatility index is up 150% the past year. Long dated bonds, like the TLT ETF, have done even worse than supposedly riskier S&P 500 equities. A stabilization of bond prices, and yields, is one of our three positive catalysts for the fourth quarter. It would ease global macro stresses and give needed valuation relief.

VALUATIONS & VIGILANTES: The bond slump impacts have been broad. We highlight two: lower equity valuations and return of ‘bond vigilantes’. Higher bond yields have mechanistically forced up the risk free rate, and pushed equity valuations down. The S&P 500 P/E is down 35% from its peak levels. It remains under pressure, with our ‘fair value’ below current levels. Bond vigilantes have also flexed their muscles. They forced an emergency policy reversal on the UK. On the government’s unfunded tax cuts, and Bank of England’s ‘quantitative tightening’ bond sales. This warning should also be keenly felt by others, like Italy’s newly elected government.

ROUT TO EASE: We see some hope this bond rout may be easing. This is a key ingredient for any equity recovery. Fed policy rate expectations have sharply repriced higher. Inflation break evens are falling. Recession risks rising. Our copper/gold ratio gives support. Bonds should be coming back into the tool kit for many, whether shortest duration savers or longer duration investors. US 2-year, 5-year, and 10-year Treasury note futures are now on the eToro platform.

All data, figures & charts are valid as of 03/10/2022