BUCKLE UP: Investors are panicked by the Fed’s unprecedented double-barrelled hiking cycle and balance sheet run off, and Bank of England’s stark ‘stagflation’ forecast of 10% inflation and recession by end of this year in a G7 economy. Risks are manifold across US, Europe, and China, whilst valuations provide little overall support yet. But we see room for ‘less bad’ news from peaking 8.5% inflation and an already hawkish 3.5% rate cycle, with earnings resilient, sentiment very depressed, and good risk/reward to buying ‘corrections’ or ‘4% down-days’ over 12 months. We strongly focus on cheap Value and cash-flow defensives. It’s too early for tech.

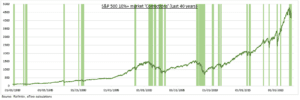

REWARDS: The S&P 500 is now down -14% from its peak coming into the year 18 long weeks ago. This is nearing the magnitude of the average -17% ‘correction’ and has lasted longer. The risk/reward to buying this typical correction over the following 12-months is strongly positive. Similarly, buying the rare (around once every 18 months) large ‘4%’ down day we near saw yesterday has a c20% average 1-year return. Also, our contrarian investor sentiment indicator is already at levels only seen before in the depths of 2020 covid and 2008 financial crisis crashes.

FUNDAMENTALS: 3%+ US 10-yr bond yields are pressuring valuations ever lower. Our ‘fair value’ P/E has further downside risk. Bond yields will not rise forever, but we are in uncharted territory with Fed’s massive balance sheet roll off. By contrast earnings continue to deliver, up 10% in US and 35% in Europe in Q1, and resilient to the macro maelstrom for now. It’s too early for tech, until bond yields peak. After the 2000 ‘tech bubble’ Growth lagged Value for 3 years.

All data, figures & charts are valid as of 05/05/2022