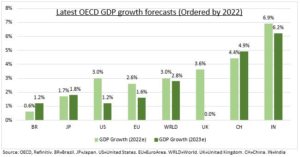

OUTLOOK: The rich-country OECD club is the latest to cut its global economic outlook. With slower 3% GDP growth, down 1.5 points from December, and sticky ‘high-for-longer’ inflation. This reinforces the new investment world, of less growth and returns, and more inflation, interest rates, and market volatility. We stay invested, for a sustainable U-shaped upturn later in the year, as growth remains resilient and inflation peaked. But cautiously positioned, with risks still high. Focus cheap, defensive, ‘inflation-hedge’ assets, from commodities (XLE) to healthcare (XLV).

SLOWDOWN: World is slowing but not heading for recession (see chart), even though risks are biased to the downside. UK is the global ‘stagflation’ poster child, but strong FTSE100 this year reminds economies not stock markets. EU (EZU) avoids recession, but risks are especially high. US is also slowing sharply as the Fed sets policy tightening pace. Countries from China (MCHI) to Japan (EWJ) buck the downtrend, putting a focus on diversification and overseas markets.

RISKS: OECD highlights other key macro issues. 1) Wildly different inflation drivers, with the US facing the ‘stickier’ problem. 2) The huge risk to European growth and inflation if see Russia gas-shutdown. 3) Wide housing market differences, with Australia and Norway most vulnerable. US lead indicators, from lumber to builder stocks, are plunging. 4) The big policy gap between Fed, ECB, and Bank of Japan, that is playing out in currency markets, led by the plunging JPY.

All data, figures & charts are valid as of 08/06/2022