CORRECTION: NASDAQ is well into a -10% ‘correction’, and the S&P 500 is near. A hawkish Fed has been exacerbated by a mixed Q4 earnings start, and Russia-Ukraine geopolitics. This has been an investor triple-whammy. The Fed is the key. Markets have priced much tightening already and the sell-off is already dampening financial conditions. A balanced Fed at Wednesday’s meeting, as we expect, would help calm markets. A more hawkish Fed would stoke ‘policy mistake’ fear. The yield curve is flattening and PMI’ slumping. We are positive, focused on cheaper and faster growing sectors and international markets.

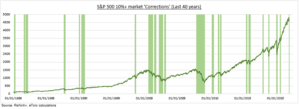

PERSPECTIVE: S&P 500 corrections are rare, with only 25 the past 40 years, clustered around crises (see chart). They average a -16% fall over seven weeks and it pays to buy them, with markets typically higher on a 12-month view. The key is avoiding ‘crashes’, which are much fewer (tech bubble, global financial crisis), but deeper and longer lasting. It pays to be diversified, with a 16pp gap between best (utilities) and worst (tech) sectors.

VIEW: Q4 earnings have beaten consensus by 6% so far and are up 24%. Every sector is ahead of expectations. Valuations are high and under pressure. But supported by record company profitability and still-low bond yields. Geopolitics is boosting uncertainty, but rarely has lasting market impact. Investor sentiment is approaching attractive capitulation levels. 47% investors are bearish and VIX touched 2 standard deviations above average.

All data, figures & charts are valid as of 24/01/2022