HERE TO STAY: The US dollar (DXY) rally has come off the boil after its 19% surge this year. This performance only lags oil amongst major assets. The greenback has been put on the back foot by hopes of a coming Fed rate hike slowdown and the latest equity bear rally. The dollar is expensive and most of its outperformance in the rear view mirror. But it remains well-supported with interest rate differentials set to stay wide, and global risks not disappearing overnight. This is a recipe for some relief, from commodities to EM, but not a reversal. The latest deep dive on global currencies from the central banks bank, BIS, makes the US dollar’s dominance clear.

DOMINANCE: Currencies are easily the most liquid of all asset classes. Their estimated $7.5 trillion daily trading value dwarfs the under $1.0 trillion for both global equity or US fixed income markets. And it is continuing to grow, with volumes 14% higher than the last survey in 2019. The dollar dominates this, on one side of 88% of all currency trades. And this weight is unchanged in recent years, with the EUR, JPY, GBP, and CNY all lagging way behind. Whilst UK dominates currency trading, at 38% of total, holding on to a narrowing historic and geographic FX position.

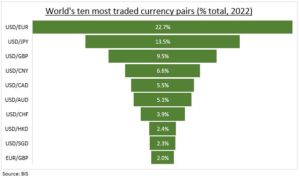

REST OF PACK: USD/EUR is by far the most liquid currency pair (see below). It dominates the emblematic DXY US dollar index with a 58% weight. The most liquid non-USD currency pair is the EUR/GBP, at only 10th with a 2% trading share. More broadly, developed market currencies dominate the volume ranks. Emerging markets are only 13.8% of volume. This excludes China’s CNY growing to a 5th placed 7%, up from 4%. Though still dwarfed 2:1 by its global trade share.

All data, figures & charts are valid as of 01/11/2022