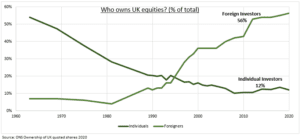

READ-ACROSS: The latest official analysis of who owns UK equities, the world’ no.3 market, has global lessons. With the growth of foreign ownership, now 56% of UK equities (see chart), as markets internationalize and it becomes easier to diversify overseas.

IMPACTS: This can add to volatility in uncertain times, like now. With a smaller ‘captive’ investor base and sensitivity to the currency. The data also shows the long term pressure on local UK equity holders. Individual ownership fell to 12%. This likely started to reverse since the data was collected in 2020, with the surge in interest, free trading, and online platforms. Individuals are the 3rd largest owners of UK equities. Meanwhile other traditional investors like pension funds, insurance, and banks have become less relevant.

INDIVIDUALS: UK individuals own 12% of equities, or £278 billion. This is a much higher 24% among AIM stocks, a small cap preference seen in other markets. This may be under-stated, with 2020 data not fully reflecting the pandemic retail investor ‘boom’.

FOREIGNERS: Overseas investors dominate UK markets. This reflects the internationalization and globalization of investment flows, and is a trend seen in many other markets. US investors dominate (46% total), then Europe (29%), and Asia (13%).

All data, figures & charts are valid as of 03/03/2022