THE REBOUND: 2021 saw global GDP soar 6% and company profits by 50%, as world rebounded from shortest and sharpest recession in history, boosted by 9 billion vaccine doses, zero-bound interest rates, and trillions more of government spending. We forecast a more modest repeat in 2022, with still-strong GDP growth driving further earnings surprises, and low bond yields and record company profitability keeping valuations high.

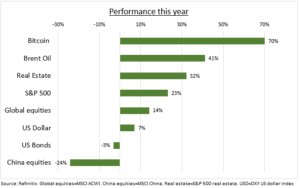

EVERYTHING RALLY: An ‘everything’ rally (see chart) was led by crypto assets which hit a $3 trillion market cap, a more than three-fold increase in under a year. Commodities and listed real estate also beat US equities, as investors flocked to hard assets with inflation the highest in forty-years. US equities saw a third straight year of double digit returns for only the 3rd time in living memory, on a record 22% earnings surprise, whilst low bond yields kept valuations 30% above historic levels at c21x P/E.

HIGHLIGHTS: Q1 saw GameStop rally. Our meme index is +220% this year, despite recent weakness. We saw a bond tantrum with US 10-yr yields near doubling to 1.7%, as GDP and government stimulus surged. Q2 saw Bitcoin fall 50% to $30,000 as China banned it, before a rebound into its first ETF. China, the world’s 2nd largest market, hit by a rolling regulatory tech crackdown with authorities’ new ‘common prosperity’ policy. Q4 saw $85/bbl oil and 8x surge in EU natgas prices, with an accelerating carbon transition. 2021 set new all-time-records for both US IPOs ($142bn) and M&A activity ($2.6trn).

This is our last daily of the year. We’ll be back on January 5th. Happy holidays!

All data, figures & charts are valid as of 21/12/2021