MISSING LINK: The US jobs market, and leading indicators like the JOLTS report, are the last big inflation drivers needed to turn lower. This would give markets hope we are within sight of a Fed interest rate peak. This is not a ‘pivot’, but a first step. Commodities, PMI’s, inflation break-evens, supply chains, housing indicators are already falling. Fed is watching as 5% wage growth has boosted sticky services inflation. But historical analysis shows a wage-price spiral unlikely with real wages and inflation expectations falling. Hopes today are for a ‘goldilocks’ payrolls reset below 300,000 new jobs. But not so low as to stoke recession fears even more.

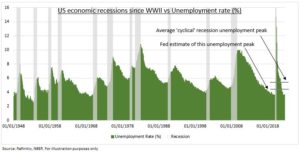

RECESSIONS: Unemployment is going to rise (see chart). The question is only how much, with a US recession now nearly inevitable. But not all recessions are equal. A typical ‘cyclical’ downturn sees a modest 2.3pp unemployment rate increase. Whilst the Fed sees an even smaller 0.9pp increase in its dot plot jobless rate forecasts. These are much less painful than ‘systemic’ recessions which see an average 3pp rise, with the global financial crisis at 4.5pp. Whilst a ‘shock’ recession is much worse, with unemployment surging 11pp during covid. But even a small increase is painful in the context of the 133 million full time jobs in the US today.

TRENDS: Longer term, authorities see US employment growing 1% a year, led by healthcare and social work, with retail jobs to fall. Occupations with the biggest growth are nurses and wind turbine technicians, seen up 44-6% by 2030. Luckily research analysts are a high +19%. By contrast typists and parking enforcers are seen falling 37-8%. The overall US labour market has regained all jobs it lost during covid, but leisure and hospitality still has much catching up to do.

All data, figures & charts are valid as of 06/10/2022