TERRIBLE Q2: The second quarter and first half ends today. It was terrible for investors, with few places to hide, and markets plunging into a bear market. Driven by a one-two punch of high-for-longer inflation and aggressive central banks, followed by surging recession fears. US and global equities plummeted over 15% in Q2 and bitcoin more than halved. Both bonds and commodities fell. Only China rose, among biggest markets, and US dollar, among asset classes.

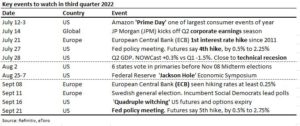

LESS BAD Q3: The race between peaking inflation and a recession is key to markets and will make for a long, hot summer. US inflation should peak and allow Fed to slow its catch-up hiking pace before recession becomes inevitable. The ECB faces an even tougher task of an interest rate lift-off with high-for-longer oil prices and grinding Ukraine conflict. Whilst growth hopes rotate to Asia as a reopening China increasingly anchors global economy and avoids another lockdown. If not enough, Q3 is typically weakest quarter of year for markets, but this is not a normal year.

VIEW: We see a volatile market bottoming in Q3 (see chart). Much has been priced in, and valuations already plunged. We are near an inflation peak, with financial conditions significantly tightened and economies slowing. Recession is neither inevitable, global, nor likely large. But risks remain high with inflation not clearly peaked yet, and earnings not fallen at all. We are invested for the inevitable upturn, but defensive for the risks. Bull markets are built on shoulders of bear markets and typically four times longer and larger. See a U-shaped second half recovery. We focus on defensives, from healthcare to high dividend, and markets from UK to China.

All data, figures & charts are valid as of 29/06/2022