2022: We are bullish a rare fourth year of strong equity returns. The earnings outlook is under-appreciated and valuations well-supported. Our focus is cheaper and faster growing cyclicals and a core of big tech ‘new defensives’. Three developments over the holidays support this recovery-centric view, even as we start to see inflation pressures easing.

BOND TANTRUM: It’s déjà vu with US 10-yr bond yields spiking, as in Q1 last year. Then yields surged 0.8%, Value beat Growth by 10%, but equities still rose 6%. We see modestly higher yields, with strong growth (Q4 GDP NOWCast 7%) and a more hawkish Fed. This helps favoured short-duration and cheaper commodities and financials (XLF).

OIL SPIKE: Brent crude prices is back at $80/bbl, up $10 in a month as omicron growth fears eased, and OPEC+ adds supply back only modestly. Energy (XLE) is the cheapest sector, with near-best earnings growth, and we see high-for-longer oil prices. Inflation fears are overdone, with expectations well-controlled and economies ‘de-commoditised’.

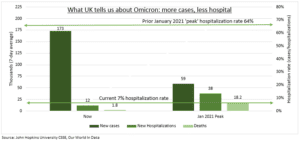

OMICRON RELIEF: Omicron is driving unprecedented virus cases in many countries, causing widespread disruption from quarantining. But the UK’s early example (see chart) shows hospitalization rates only 10% of prior waves. This is an eventual route to lower restrictions and a strong ‘re-opening’ stock recovery. South Africa and UK lead the way with peaking cases and disruption, but the US and especially Asia peaks are still way off.

All data, figures & charts are valid as of 04/01/2022