LUXURY: The sector is up 23% globally this year, neck and neck with semiconductors as the world’s best performing industry. It has powered France and Italy to double digit market gains. LVMH to be Europe’s biggest stock. Whilst our ‘King Charles’ coronation index of UK heritage brands has left the FTSE 100 in the dust. Investors have rewarded luxury’s all-weather combo of resilient demand and pricing power. The sector side-stepped the covid recession but was hit hard by the global financial crisis. when both valuations and earnings fell more than average. These stocks are now bigger, more diversified, and China’s recovery counter-cyclical. But it’s a reminder luxury is recession resilient but is not immune. These remain discretionary purchases.

RECESSION: The luxury sector outperformance this year has taken its P/E valuation premium to 65% above the global market. This compares to a 10-year average 45%. It is supported by a sustained 12% earnings growth outlook that is well ahead of the zero growth seen for global equities. But the valuation premium disappeared in the global financial crisis and earnings fell 20%. Luxury had a better pandemic, when the P/E premium only dipped to 33% even as profits growth temporarily plunged 35%. The sector is resilient to slowdown but not deeper recession.

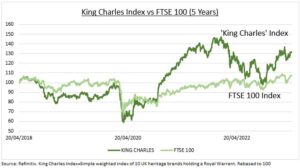

CORONATION: We created an index of ten UK heritage and luxury brands that hold royal warrants from King Charles (see chart). Its strong outperformance has been led by Watches of Switzerland (WOSG.L), the owner of jewelers Mappin & Webb, Purdey shotgun owner Richemont (CFR.ZU), Burberry (BRBY.L), Lobb shoemaker owner Hermes (RMS.PA), Fiskars (FSKRS.HE) who own ceramics-maker Royal Doulton, and tailor Gieves & Hawkes owner Frasers (FRAS). This offset losses at Aston Martin (AML.L), Twining’s tea owner Associated British Foods (ABF.L), Parker pen owning Newell Brands (NWL), and brewer Shepherd Neame.

All data, figures & charts are valid as of 04/05/2023