LEADING: The world’s most valuable stock reports earnings Thursday. This may set the tone for the market in more ways than one. Apple (AAPL) is a quarter the US IT sector, itself the S&P 500’s largest. Both in focus after a strong start to the year. Earnings have a hangover from big pandemic demand, with global smartphone sales -18% last quarter. But valuations seeing relief, from lower bond yields, after the 2022 rout. Apple has so far avoided the job and capex cuts of others, after growing more cautiously. It has led a shift to services, premium pricing, reshoring, and not been immune to ESG rise. It’s 60% of overseas sales will benefit from the weaker dollar.

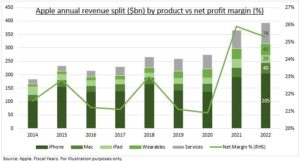

LEARNING: Apple is symbolic of many the challenges and opportunities facing big tech today. 1) It’s seen a shift from hardware towards services, like Apple Pay and Apple Music. This has doubled as a proportion of its revenue in the past several years. And driven a significant profit margin improvement (see chart). This in turn helped sustain an above-market valuation, unlike many of its big-tech peers. 2) Apple has ridden the rise in luxury and resilient premium product demand. With its $1,000 iPhones it holds 20% of global smartphone shipments but captures 80% of industry profits. This is helping offset the current brutal decline in smartphone demand.

ISSUES: Apple also faces many of the same headwinds and emerging issues others struggle with. 1) Apple has dramatically slashed its over-reliance on China in its supply chain. But this capacity has moved elsewhere in Asia rather than reshored to the US. This highlights many of the scale and cost challenges involved. 2) It has not been immune to the rise of ESG. It was one of the first to publish on its supply chain and has seen pressure over executive pay. CEO Tim Cook just took a 40% pay cut after only 64% of shareholders approved last year’s compensation plan in its ‘say-on-pay vote. See our introduction of company ESG scores and proxy voting.

All data, figures & charts are valid as of 26/01/2023