LEAP: February 29th is a rare ‘leap day’. This is the extra day we receive once every four years to realign with the solar calendar. It existed in the Roman Julian calendar and was refined in the 1582 Gregorian calendar we still use today. It’s a minor but real disruption for companies and markets, from earnings reporting through to calculating bond interest. It has typically been a poor day for markets. Though does make for a better year, maybe as it also aligns with US presidential elections. And this ‘leap day’ is a reminder that just four years ago we were starting to deal with the first covid lockdowns, with stock markets plunging, and authorities intervening.

IMPACTS: The extra day will have a number of small impacts for companies and markets to be aware of and considering. 1) First quarter company earnings will see an extra sales day, boosting revenues by c. 1%. These reports start on April 12th, with JP Morgan (JPM). Walmart (WMT), for example, has already incorporated into its projected sales growth. 2) Comparable figures, like same store sales growth, may need to be adjusted. 3) HR will need to change payroll, with increased expenses for non-salaried staff. Relevant across industries from retail to construction. 4) Accounting will need to tweak depreciation and amortisation calculations. 5) Bondholders will see an extra day of interest, and many bonds adjust their yield-to-maturity.

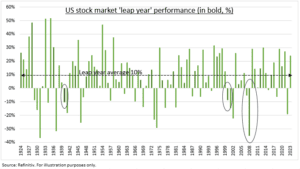

MARKET: Leap days only happen every four years. And the stock market is not open on every leap day. Since the S&P 500 index was created in the 1950’s we have seen thirteen leap days with the market open. It has only risen on five of those. Or a lower than average 38% of the time. The better news is that leap years have much better performance. Maybe because it coincides with the US election cycle. In the past century, US stocks have risen 88% of the time in a leap year. Only falling in three: in 1940, 2000 tech bust, and 2008 global financial crisis (see chart).

All data, figures & charts are valid as of 28/02/2024.