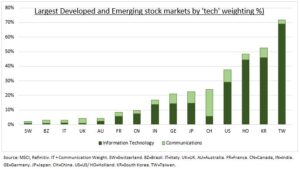

KOREA: South Korea is the world’s 12th largest economy and one of its economic ‘miracles’. Tripling in size the last 20 years and taking GDP/head to $33,000. This is more than Spain and closing in on Japan. It’s also home to one of the world’s most tech-heavy stock markets (see chart), including Samsung Electronics (SMSN.L), LG Display (LPL), and SK Telecom (SKM). Yet its $800 billion market. cap. (EWY) is still considered only ‘emerging’ by MSCI. The world’s most influential global index provider is now considering an overdue upgrade of Korea to ‘developed’ market status this month. This would make Korea a smaller fish in a bigger investing pond. Driving inflows from the $10 trillion global tracker fund industry into the stock market and Won.

IMPACT: MSCI is the only one of the ‘big 3’ stock index providers (alongside FTSE Russell and S&P Dow Jones) to still consider Korea an ‘emerging market’. They cite various capital market restrictions that the authorities are now vowing to change, in an effort to slash the ‘Korea discount’. This makes its stock market one of the world’s cheapest. At only 10x prospective P/E it’s 40% below the US. An upgrade would see many of the estimated 1,380 funds, with $1.3 trillion of assets, that track MSCI follow suit. South Korea would go from being the 4th largest market in the ‘emerging market’ index (EEM), with a 12% weighting after China, Taiwan, and India. To one of the 23 markets in the developed markets index (IDEV), with an estimated 1.5% weighting.

MSCI: First clues will come with MSCI’s June 8th Market Accessibility Review of Korea’ progress in the needed FX market liberalization, English information disclosure, and easing short selling restrictions. Then on June 22 we will see its actual Annual Market Classification Review decision. And if successful the likely lengthy timetable to eventual developed market inclusion.