Wise and Revolut have been leaders in the fintech cross-border transactions space, disrupting traditional banking systems. With Revolut’s IPO possibly coming in 2025, it is interesting to compare both companies to determine whether Wise is positioned to challenge Revolut’s dominance or if the two serve different purposes for investors.

Key Highlights

- Wise trades at a fraction of Revolut’s private valuation.

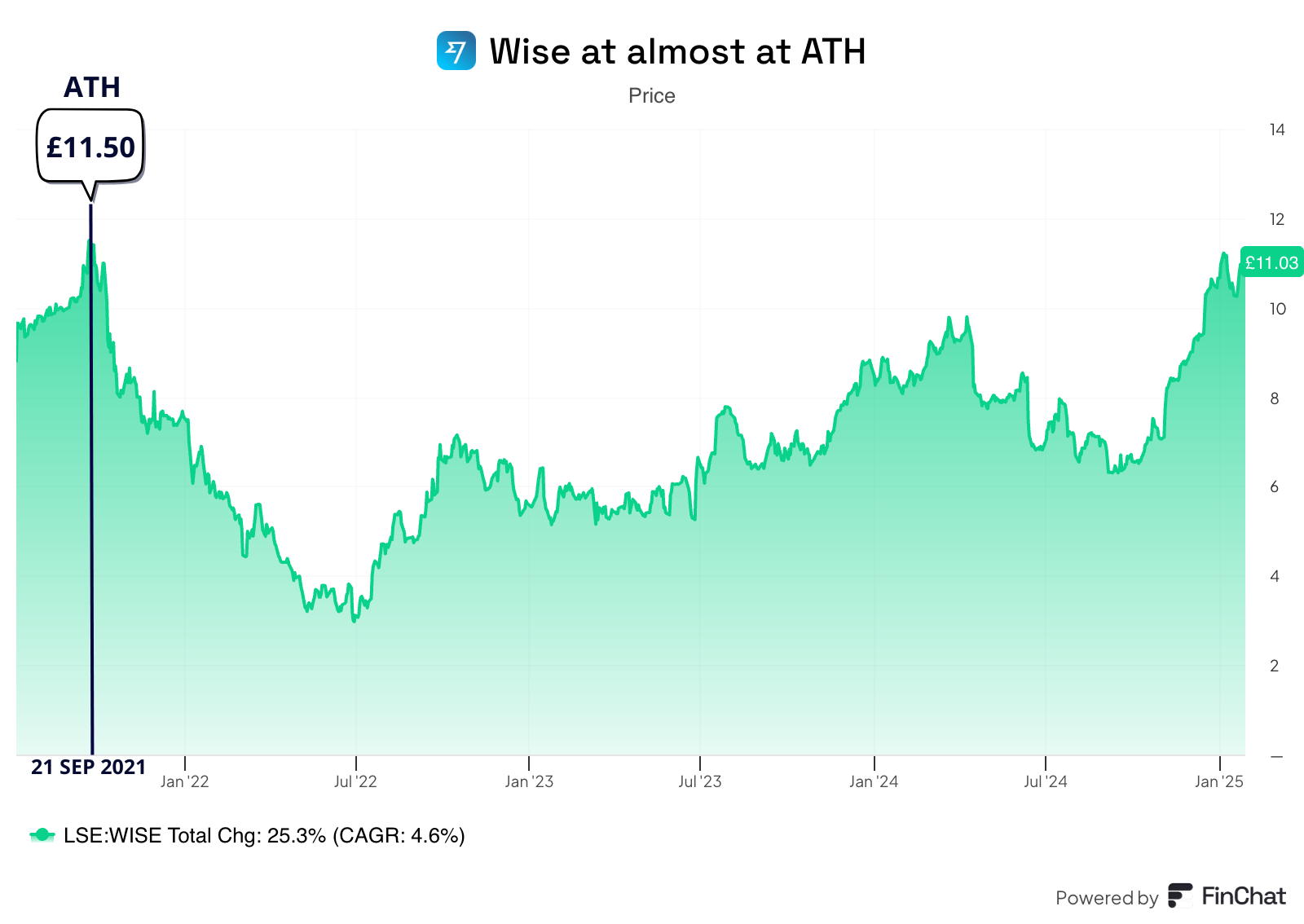

- Wise Nearing All-Time Highs, but still not expensive.

- Banks are positioning in the battle to come: Wise deals.

Seeing Revolut Everywhere

During a recent trip to Spain, I couldn’t escape Revolut’s ads. Aggressive marketing and IPO rumors got me thinking: How will a publicly traded Revolut affect Wise? While both are fintech companies, and disruptors to traditional banking, their strategies and business models differ significantly.

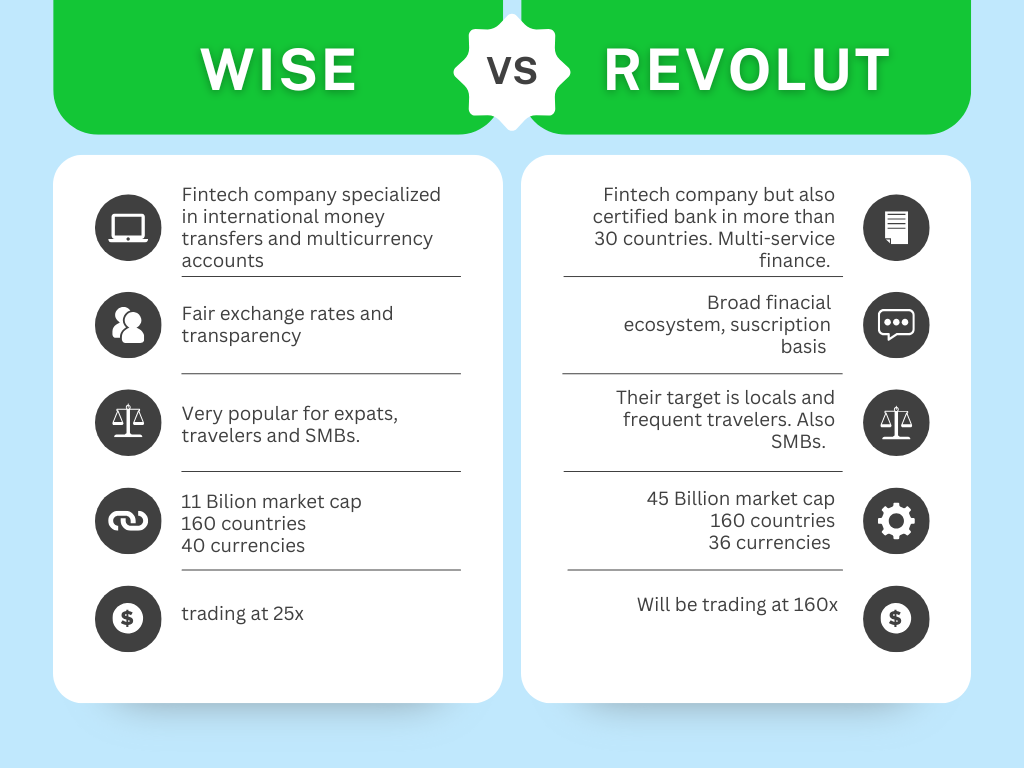

Wise’s mission is clear: low-cost, transparent, and efficient cross-border transfers. Revolut, on the other hand, aims to become a global financial super-app, offering everything from banking to crypto. Given these distinct goals, should investors really be comparing the two?

Revolut’s IPO details are still scarce, but a secondary share sale occurred in August 2024, points toward a $45 billion valuation. That’s a massive valuation, especially for a company that, while growing fast, hasn’t consistently been profitable. Meanwhile, Wise is trading at 25x P/E with steady profitability and a strong return on capital. Let’s take a closer look at their business models.

Businesses Model Breakdown: Wise vs. Revolut

Wise is one of the world’s fastest growing fintech, while being very profitable. Launched in 2011, the business is listed on the London Stock Exchange under the ticker, WISE. In fiscal year 2024, Wise supported around 12.8 million people and businesses, processing approximately £118.5 billion in cross-border transactions, and saving customers over £1.8 billion, according to the information provided by the company.

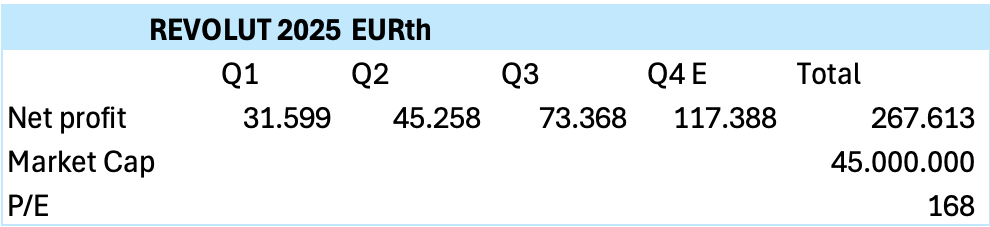

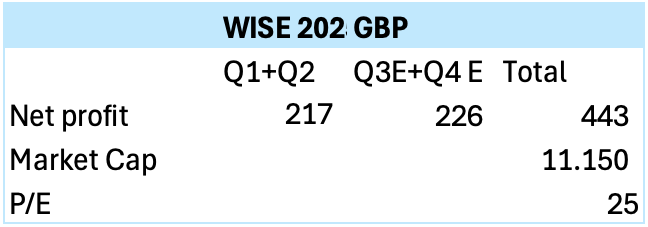

The real valuation of Revolut’s IPO is still uncertain, although the available information points to a $45Bn value, given recent transactions. Since the last annual statement available for Revolut on their website is dated for 2023 and the latest financial report was with date 30 of September 2024, I had to make some average predictions to compare both companies:

1 GBP in millions

2 EUR, in thousands

As a reference, Revolut’s valuation would be almost 7 times Wise’s current valuation. This means two things, potentially: Wise is undervalued and Revolut is overvalued. In my opinion, both are correct, and I wouldn’t invest in Revolut given the latest known valuation.

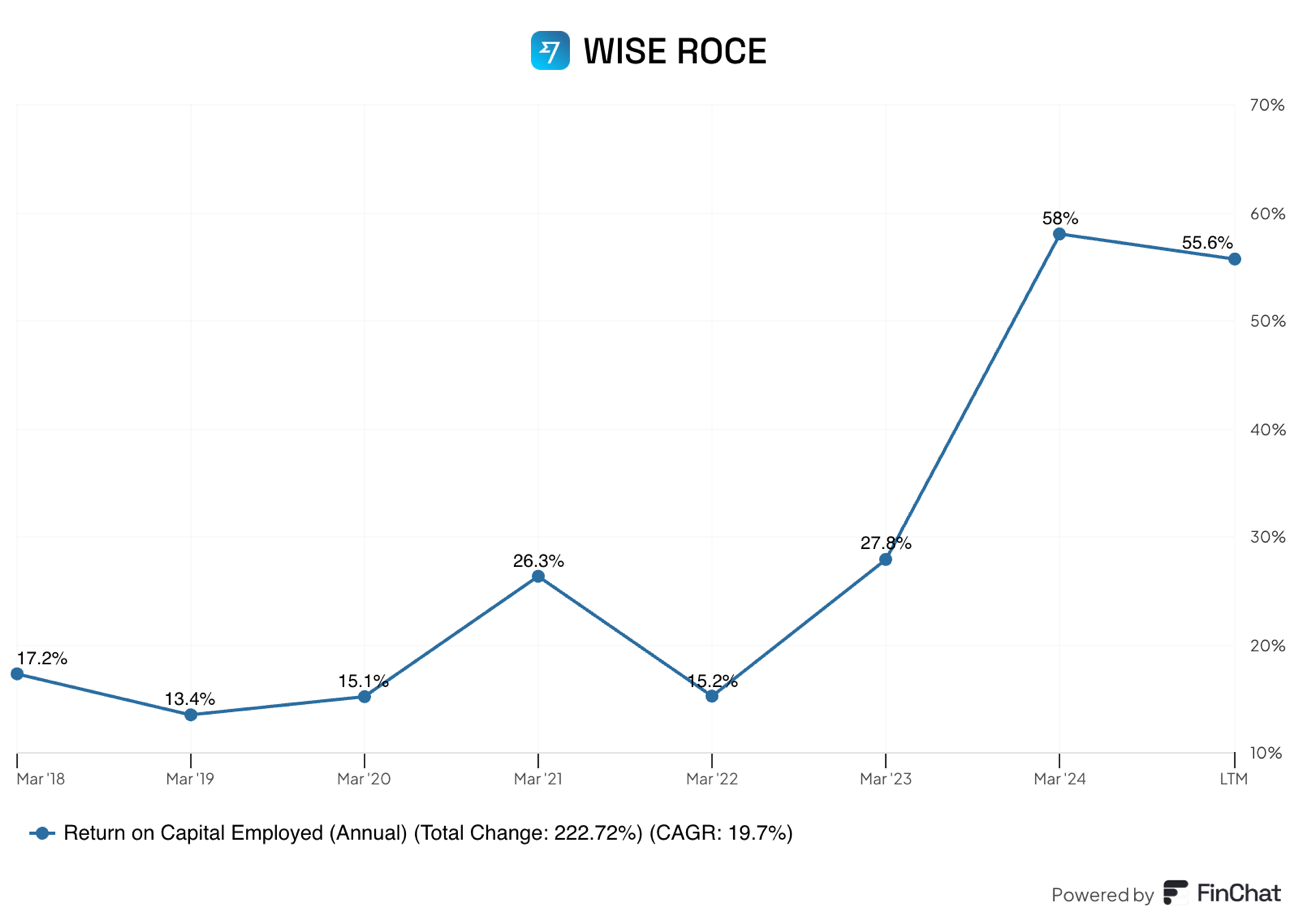

Wise, trading at 25x P/E, is an interesting opportunity, growing 15-20% annually. With solid returns on capital employed since 2018, proving the management commitment in cost reduction and increase the shareholder’s profit.

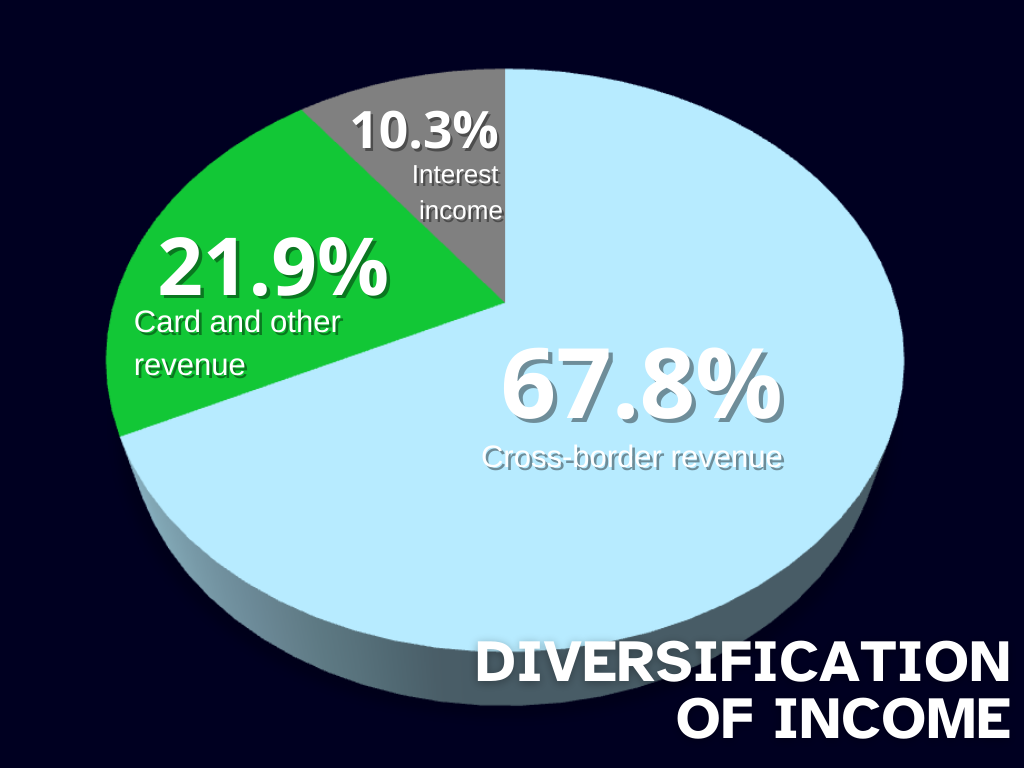

Wise is a Fintech (used to describe new technology that seeks to improve and automate the delivery and use of financial services). Using Wise’s platform, customers can move their money abroad to 40 different currencies in only one account. The company primarily generates revenue from money transfers, conversion services and debit card services. Wise also generates revenue from its multi-currency investment feature. This feature allows customers to purchase units in investment funds, provided by fund managers, using their Wise account balance.

The customer growth rate has been of 29% in 2024 compared with 2023, even thought, they had to pause wise business new accounts because they’re growing too fast for their capacity! This year they’re focused on invest in infrastructure to get the ability to supply the huge existing demand.

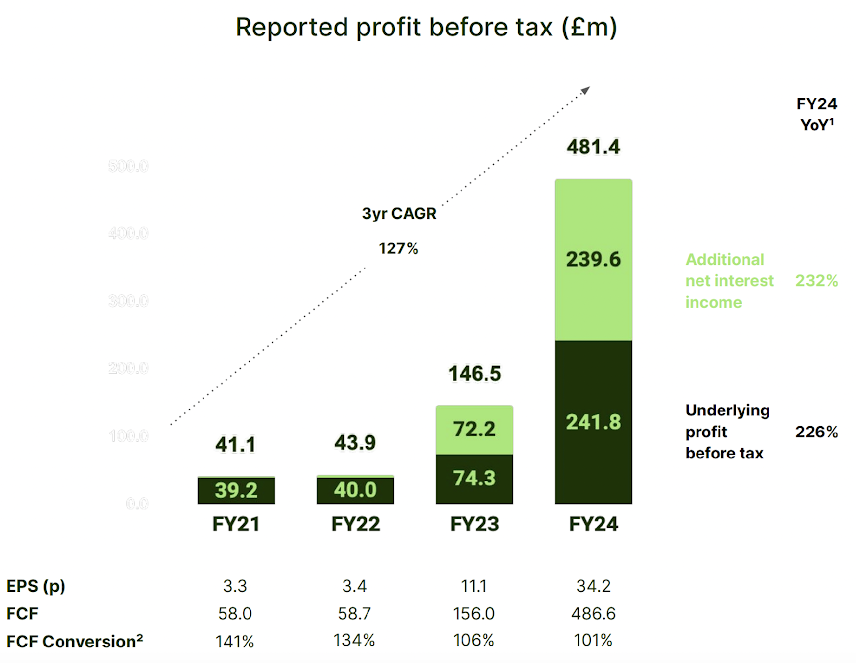

The last part of the revenue that is important to highlight is the interest income with a 10.3% of the revenue with a value of 120.7m (this revenue only considers the interest income of the first 1% yield. If we consider all the interest income, under and over 1%, it would be 485m). This is made from investments in money market funds, listed bonds, and interest from cash at banks.

To create a transparent and realistic way to move your money abroad, they consider the mid-market exchange rates which is the price the banks are willing to pay for buying or selling the currencies, and the mid-point between both is the mid-market exchange rate (the fair rate as well). This is considered the “real” conversion rate, and that’s the main difference with banks, they do not usually share the real conversion rate with you, because they put the margin on top of the real rate.

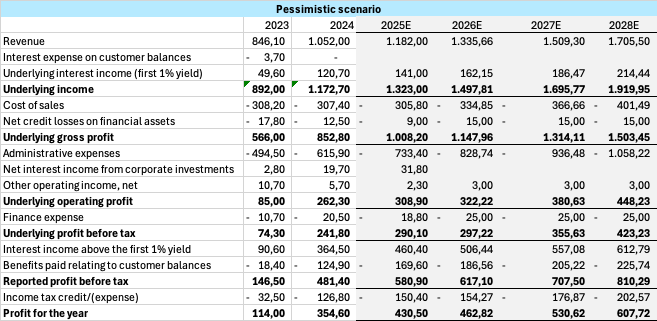

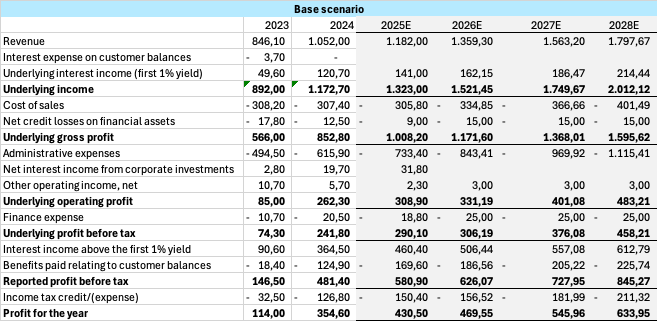

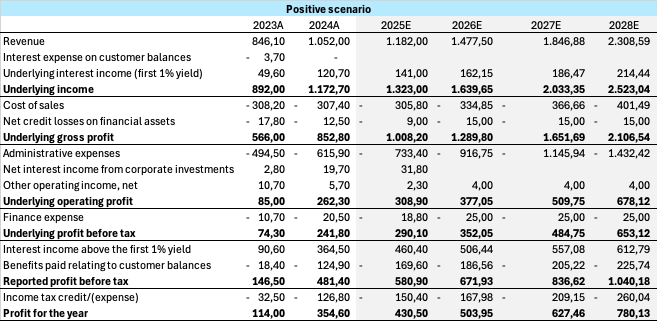

Investment thesis

As we are close to the end of their end of financial year, expected in March 2025, I made some estimations of what could be the future of the revenue of the company, (when I first bought a Wise share, my estimations, even the positive one were so low compared with today results) I had to renew my scenarios to date, making new estimations for the period (2025-2028) for the pessimistic scenario I estimated a growth of 13% annually, which is lower than their own expectations of a 15-20% growth CAGR. For the base scenario I considered 15% growth of revenue, just right in the low range of their expectations , and for the positive scenario a very optimistic growth of 25%.

Using the mid-point growth estimate of the company (15%), and being conservative on the interest income that Wise will have in the future, we could see an increase of over 44% net income. Thus, using the same multiple that the company trades today (25x) we would have a return of over 44% in three years (Because the 2025 results are almost here and are in base of the last semester results).

If we consider the net cash position of the company, which stays at 800m, (excluding the customer’s held balance), the company trades even lower, which could give us even more upside. Adjusting the net cash position, the company’s PE ratio is around 24 times earnings. We would always leave room for multiple-expansion, which given the company’s growth, return on capital employed, and profitability, is a very likely possibility.

However, with the stock near all-time highs, is it still a buy? With customer growth at 29% YoY and cross-border volumes up 24% to £37.8B, Wise’s fundamentals look strong, with an average ROCE of 30% in the last 5 years, with clear competitive advantage through their red of partnerships worldwide, growing the number of customers +20% quarterly.

But could they keep the pace in growth in the long term? The TAM (Total Addressable Market) of the cross-border payments has shown an annual growth of 3%, Wise’s estimation from their annual report in 2024 are that in 2027 it will achieve a total amount of £28.5 TRILLION between retail, SMBs (Small and medium business), and enterprises. In 2024 the TAM only for retail was £2 trillion moved annually. All this information means, that there’s around £28.5 trillion in opportunities for the infrastructure of wise which is currently having less than the 1% of the market share. But this doesn’t mean that there’s no risk associated with the business, here we will explore some of the main risks for Wise.

WISE’s RISKS.

-

Competition. According to an analysis made in Statista in 2023 banks worldwide are worried of the cross-border transactions and they want a modern solution, this means we could see more banks trying to innovate in their processes and reduce cost and expenses. This is a risk for wise, considering that if your bank of all your life offers you a better rate, you won’t need to have a second app to make transactions.However, Wise’s plan to overcome this, is working together with banks worldwide, offering their ready to connect infrastructure, and complying with every country’s different regulations. Being partner with a substantial amount of more than 90 companies from diverse sectors, including banks, which is an important network to help the improving of reducing SWIFT costs, and time. We also must consider the scale of the company, operating in over 160 countries.The latest news was when Morgan Stanley announced the agreement with Wise to facilitate the foreign exchange international capabilities for corporate customers, this is a great milestone because this is the first investment bank to enable these on wise, this is the beginning of many other banks choosing follow this path, as is the case with Standard Chartereds a bank in Asia, Africa and the Middle East. All of these new relationships mean global presence for Wise.

- Fines and compliance that compromise WISE’s mission. Last January the Consumer Financial Protection Bureau ordered Wise to pay nearly $2.5 million for a series of illegal actions, the most concerning act was the disclosure of the 6 digit conversion rate, the CFPB said the guideline is between 2 and 4 digit, what make us question if this “Unfair competition” could possibly affect the customers in the US, that is more than three million of people between the 48 states, the District of Columbia, Guam, the U.S. Virgin Islands, and Puerto Rico, in the matter of their mission to make transparent transactions. I haven’t found any communication from Wise to find how they’re expecting to fix this. However a $2.5 milion isn’t a significative amount considering the free cash flow of the company.

- Currency Volatility. Fluctuations in exchange rates could affect profitability, but most of the revenue come from fees in conversion and transfer.

- The stagnation of the company’s growth is a valid concern. If the growth that we are expecting doesn’t materialize, the valuation and the multiple that the company trades at can be harmed. However, the loyal base of customers (“evangelical customers” as they call them) creates an incredible growth in customers, the TAM showed us the possibilities are still with space to growth, as the example of the entrance of WISE on January to the Mexican market, and the new partnership with global banks, makes unlikely the stagnation in the coming three years at least.

- Digital currencies and cryptocurrencies, with globalization of this type of currency, and every time more countries acknowledging the uses of it, we could see a digital globably accepted, as is the case of the Inthanon-LionRock between Thailand and Hong kong or project Aber between Saudi Arabia and the UAE. So eventually you could stop needing to exchange your money to different currencies, with just one asset you could pay in China, US and in Venezuela. I believe this could be the future but in an ideal world. It would need too much cooperation between nations, and this is hardly likely in the coming 20 years at least.

- Credit risk. To assess this issue, the company has a very conservative approach to invest their customer’s balance. As of their latest report, only 36% of their cash position is invested in market funds (3.776m out of 10.479m), while the rest is in current accounts. Regarding their short-term investments, almost 100% of the money is invested in Aa and A instruments, creating a robust and solid balance sheet for the company.

Conclusion

Wise was my best investment in 2024, but in 2025, it’s time to reassess. At 25x earnings and near all-time highs, is it still a good deal? Initially, Revolut’s IPO seemed like an alternative opportunity, but after reviewing the limited data available, its rumored valuation could be seven times higher than Wise’s current multiple.

For now, my focus remains on Wise, trading at 25x but growing rapidly in both customer base and global expansion. With no debt, a global infrastructure advantage, and a leadership team aligned with shareholders’ interests (CEO and co-founder Kristo Käärmann still owns 18% of the company) Wise remains a compelling long-term investment.

What do you think? Will Revolut’s IPO be a game-changer, or is Wise still the smarter bet?

Sources

Wise annual statement 2024

Analyst presentation 2024

Revolut annual statement

https://wise.com/imaginary-v2/images/2bbbb368c98fe4aa7b2aa3e133341520-FY24_Analyst_Presentation_.pdf

https://www.revolut.com/news/revolut_announces_secondary_share_sale_to_provide_employee_liquidity/

https://www.statista.com/topics/11647/cross-border-payments/#topicOverview

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.