It answers billions of searches daily, powers the world’s biggest video platform, dominates online advertising, and is making a massive push into AI and even self-driving cars; Google is everywhere. With over $90 billion in cash and annual profits exceeding $100 billion, Alphabet, Google’s parent company, is one of the world’s most influential companies. But with regulatory threats looming and fierce competition in cloud and AI, can Google keep delivering for investors? Let’s find out.

- Google is a money-making machine. It continues to grow its advertising business while innovating in cloud and AI. In 2024, it raked in over $100 billion in profit and ended the year with $90 billion in cash.

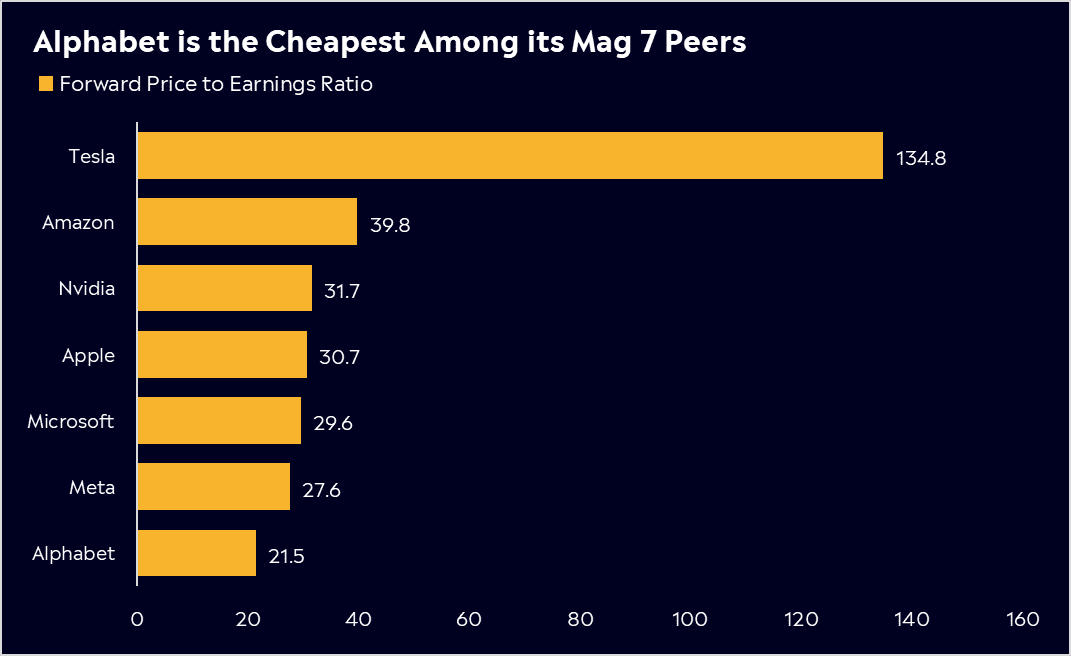

- Alphabet currently trades at 21.5x forward earnings, a compelling valuation given its trading at a discount to the S&P500 which is currently 23x price to earnings.

- Wall Street likes it – Alphabet has 59 Buy ratings, 15 Holds, and 0 Sells. From these ratings it has an average price target of $218.60.signalling a potential 14% upside.

Explore Google

The Basics

Google was founded in 1998 by friends Sergey Brin and Larry Page, starting from a rented garage in California. Today, it’s one of the most dominant businesses in the world, renaming itself Alphabet in 2015. This was because Google became more than just Google. Although Google generates most of its revenue from digital advertising, a massive $265 billion in 2024, its reach extends far beyond search.

The business generates its revenue from three key revenue segments:

- Google Services (87% of revenue) This is the moneymaker. Google’s dominance in search, video, and email makes it the world’s biggest digital advertising business.

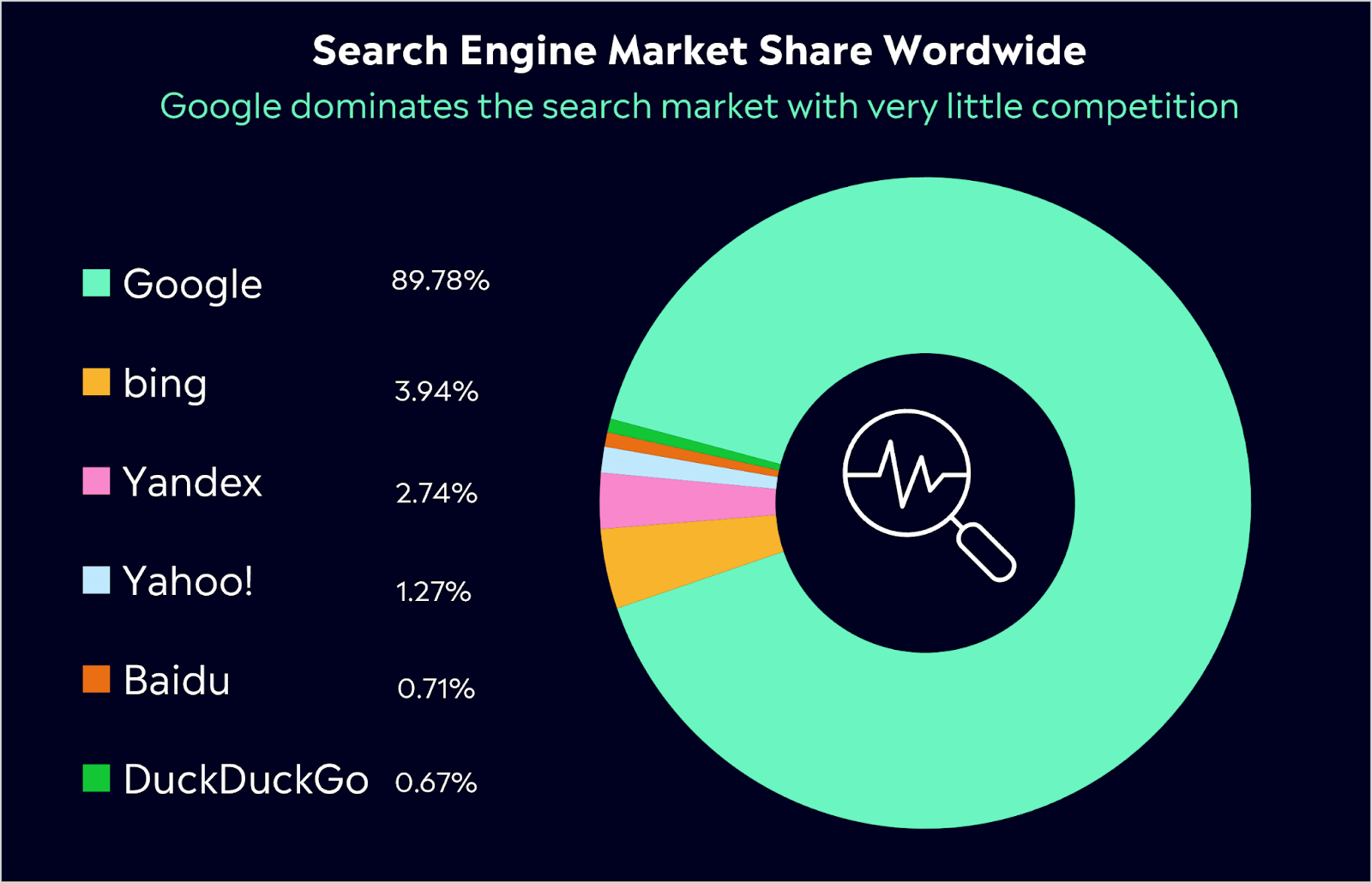

- Search – The backbone of Google, handling over 8.5 billion searches per day and generating billions in ad revenue.

- YouTube – The world’s second-largest search engine (behind Google itself) and the biggest video platform, monetised through ads.

- Android & Google Play—With over 3 billion devices, Android is the most-used mobile operating system in the world, with a 72% market share, according to Statista. Yes, more than iPhone’s iOS, which has just 27.5% market share. Android generates revenue from app sales, subscriptions, and Play Store fees.

- Chrome, Gmail and Maps – While free for users, these services keep people in Google’s ecosystem, feeding data into its ad business.

- Google Cloud (12% of revenue)

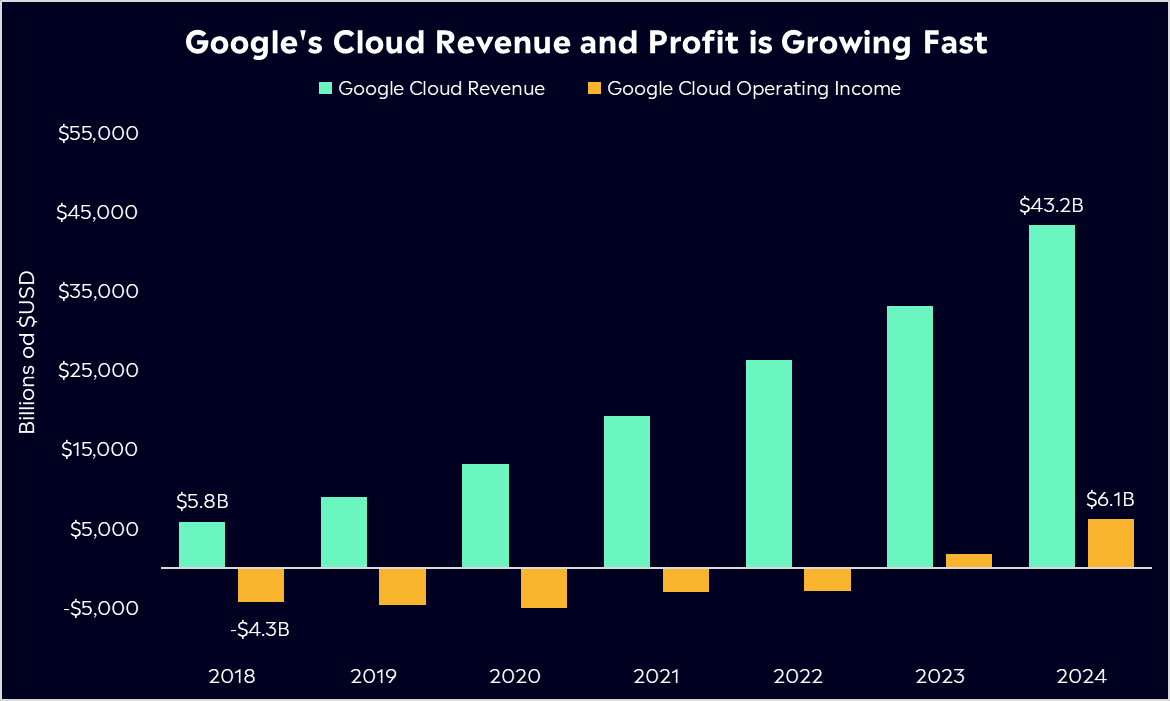

Google Cloud powers businesses, AI models, and digital services worldwide. It competes with Amazon Web Services (AWS) and Microsoft Azure, helping companies store data, run applications, and build AI tools. This segment also encompasses Google Workspace: Google Meet, Drive and Docs. Google Cloud has been Alphabet’s fastest-growing segment as demand for AI and enterprise cloud services continues to soar. But it’s still playing catch-up to AWS and Microsoft.

- Other Bets (Under 1% of revenue)This is where Alphabet dreams big. Some of these projects could shape the future, while others might never make a cent.

- Waymo – Self-driving cars that could change transport forever.

- DeepMind – Cutting-edge AI research.

- Nest – Google’s smart home division division. Yes, it’s those little doorbell cameras!

Alphabet’s long-term growth story has rewarded investors in the last decade. Shares have risen by more than 670%, giving an annualised return of 22%. To keep the stock attractive for retail investors, Alphabet has split its stock three times, now trading at around $205.

Fun Fact: Alphabet acquired YouTube for $1.65 billion in 2006. Alphabet makes around $1.65 billion in revenue from YouTube every 2.5 weeks. YouTube also has 2.5 billion monthly active users and is Australia’s 2nd most visited website, behind… Google. Dominance.

Past performance is not an indication of future results.*Source: Global Stats StatCounter

Competitor Diagnosis

Alphabet faces pretty stiff competition across all of its key business areas. In advertising, it’s fending off Meta with its suite of social apps, and TikTok continues to be a new formidable force up against YouTube. Google remains the dominant search engine but faces challenges. AI-powered search is still evolving, but companies like Perplexity AI want to disrupt traditional search models. Meanwhile, Microsoft’s deep partnership with OpenAI gives it an edge, integrating AI directly into Bing and enterprise tools through Copilot.

One of Google’s significant competitive advantages is its long-standing relationship with Apple. In 2005, the pair signed an agreement to make Google the default search engine for Safari, which still stands today. Given the massive iPhone user base, being the default search engine on Safari is crucial for Google, as it drives significant search traffic and ad revenue.

Amazon (AWS) and Microsoft (Azure) are the dominant players in cloud computing, while Google Cloud is doing what it can to gain market share. While it’s still playing catch-up, Google Cloud’s profitability turned positive for the first time in 2023, a key milestone in its expansion.

A big challenge to consider is the crackdown from US regulators. The Department of Justice has said that Google unfairly maintains a monopoly in search and online advertising. The DOJ could force Google to break up, potentially separating its search, advertising, or cloud businesses. This would fundamentally reshape the company. A Trump Presidency could be good news here, particularly with his stance on less regulation. CEO Sundar Pichai attended Trump’s inauguration as he looks to do what he can to stop any crackdowns. Trump’s relationship with big tech hasn’t always been one way; he has previously accused Google of bias in search results. However, a more business-friendly administration could ease regulatory pressures.

Alphabet’s focus on integrating AI and cloud technology into its business is positioning it to stay competitive while its massive user base keeps its advertising machine rolling.

Financial Health Check

Alphabet reported its earnings earlier in the week, and the Q4 result was pretty uninspiring. Revenue missed estimates, and Google Cloud, its key growth segment, did not live up to expectations. There were bright spots. Google’s search, advertising, and YouTube revenues were ahead of estimates, but the focus has been on Cloud.

- Overall Q4 Revenue $96.47 billion +12% y/y, estimate $96.62 billion

- Google advertising revenue $72.46 billion +11% y/y, estimate $71.73 billion

- YouTube ads revenue $10.47 billion +14% y/y, estimate $10.22 billion

- Google Cloud revenue $11.96 billion +30% y/y, estimate $12.19 billion

Google’s advertising revenue is its bread and butter through its search business but this is now a mature business with revenue set to grow in the single digits next year. For investors, the focus is on cloud, where the company is seeing rapid growth, with operating income up over 250% in 2024. Importantly, Google’s search ad revenue keeps rising despite the rise of AI search. The miss on revenue in its cloud business is crucial because it failed to reassure Wall Street that its heavy investments in AI are translating into better-than-expected growth. That concern is more relevant than ever with the emergence of DeepSeek and the fact that Alphabet also said they see capital expenditures at around USD$75 billion in 2025, almost USD$20 billion more than analysts had expected. This shows their commitment to growing data centres, AI infrastructure, and other technologies. That may seem like a big number, but Alphabet’s net profit rose to $100 billion in 2024.

However, this was one quarter. Google Cloud’s margin growth has been solid since 2018, growing at a remarkable pace. For the full year 2024, its EBIT margin reached 14%, jumping to as high as 17.5% in the most recent result. For some context, this was -74% in 2018. That growth has helped expand Alphabet’s overall profit margins for the year. It’s also worth noting that the business has a serious cash pile. Free cash flow remained strong at nearly $25 billion for the quarter. For the full year 2024, Alphabet had USD$95 billion in cash, which is set to grow to USD$153 billion in 2025. All in all, its Q4 report was okay; it certainly wasn’t magnificent. When you’re spending as much as they are, investors want consistent growth and will become impatient if they don’t get that. Alphabet will need to justify its AI spending throughout 2025, and if it can’t, shares will undoubtedly face some pressure.

* Past performance is not an indication of future results.

Buy, Hold or Sell?

In its most recent earnings call, management noted that demand was outpacing capacity for its AI products, just one of the reasons it plans to spend $75 billion in 2025, helping to ease capacity constraints as AI demand grows. Its AI positioning is a huge positive for the company, but it must keep making market share gains in cloud to please Wall Street even if its more traditional advertising business keeps delivering.

Alphabet currently trades at 21.5x forward earnings. This is a pretty compelling valuation given the company’s strong position and the fact it trades at a discount to the S&P500, which is currently 23x price to earnings and it’s own 10-year average of 22.2x earnings.

Analysts still believe there is further upside for Alphabet shares. According to Bloomberg’s Analyst Recommendations, it boasts 59 buy ratings, 15 hold ratings, and 0 sell ratings. With an average price target of USD$218.60, that implies a potential 14% upside.With its dominant ad business, strong AI positioning, and discounted valuation, Alphabet remains a stock for investors to watch. While regulatory risks and AI competition shouldn’t be ignored, its leadership in search, cloud, and AI innovation positions it well for long-term growth.

* Past performance is not an indication of future results.

Explore Google

*Data Accurate as of 06/02/2025

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.