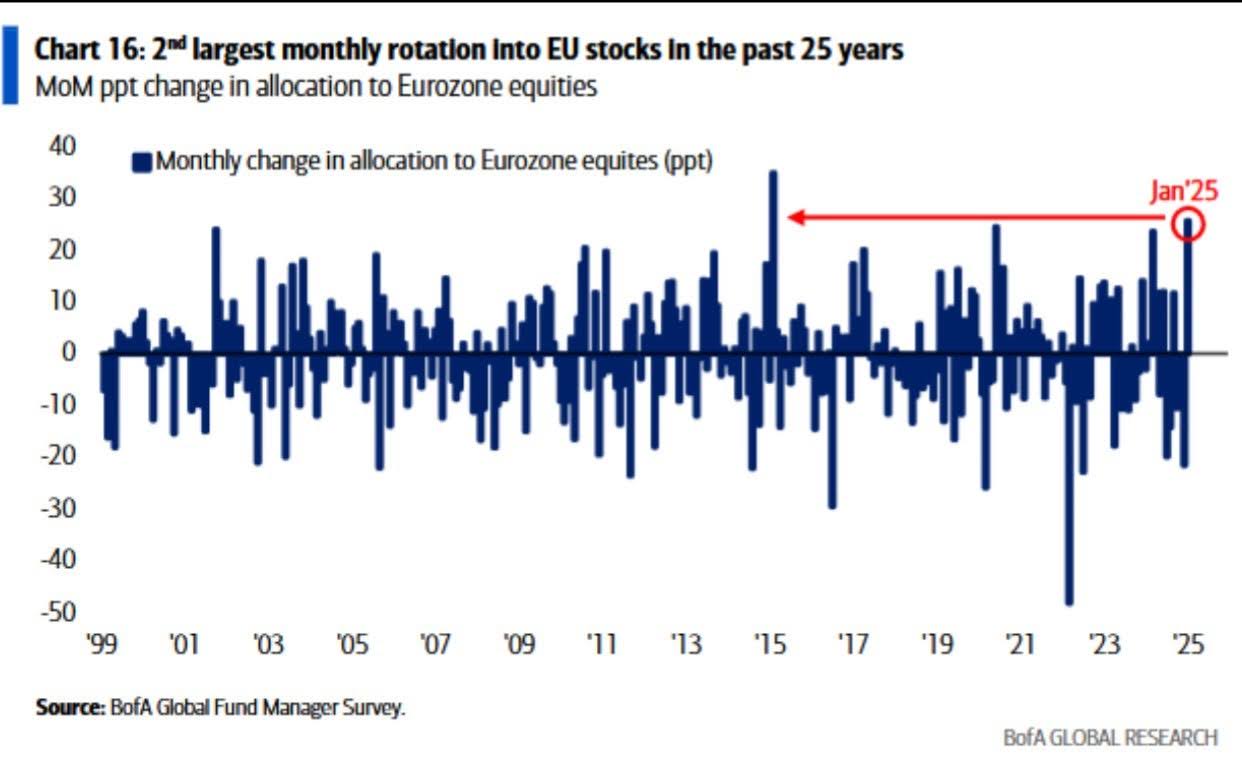

In the first month of 2025, European equities saw the largest monthly capital inflows in 25 years, according to Bank of America. This surprising development comes after the European STOXX EUROPE 600 index recorded just 6% growth for 2024 compared to 24% for the US S&P 500 index.

The euro area economy grew by just 0.9% in the third quarter, while the US economy grew by 2.7%. Preliminary data for the fourth quarter will be published this week. Although the eurozone managed to tame inflation to 2.4%, this led to a broad-based economic slowdown.

The outlook for 2025 suggests growing divergence between US and eurozone monetary policy, partly due to the new USA administration’s planned actions. ECB interest rates are already more than 1% lower than in the US and the gap could widen further. Economists expect the ECB to cut rates by up to one percentage point this year, while the US is expected to drop by only half a percentage point. This has a negative effect on the euro-dollar exchange rate, which has already reached parity.

Europe still faces many risks. Inflation, an economic slowdown, the risk of a tariff war with the US or China, a collapsing car industry, rising energy prices… the list is long.

So what brings investors back to European markets?

Banks

In the US, banks traditionally kicked off the earnings season in style. Most of them beat expectations thanks to strong interest income and a recovery in trading activity on Wall Street, especially in areas such as trading and investment banking.

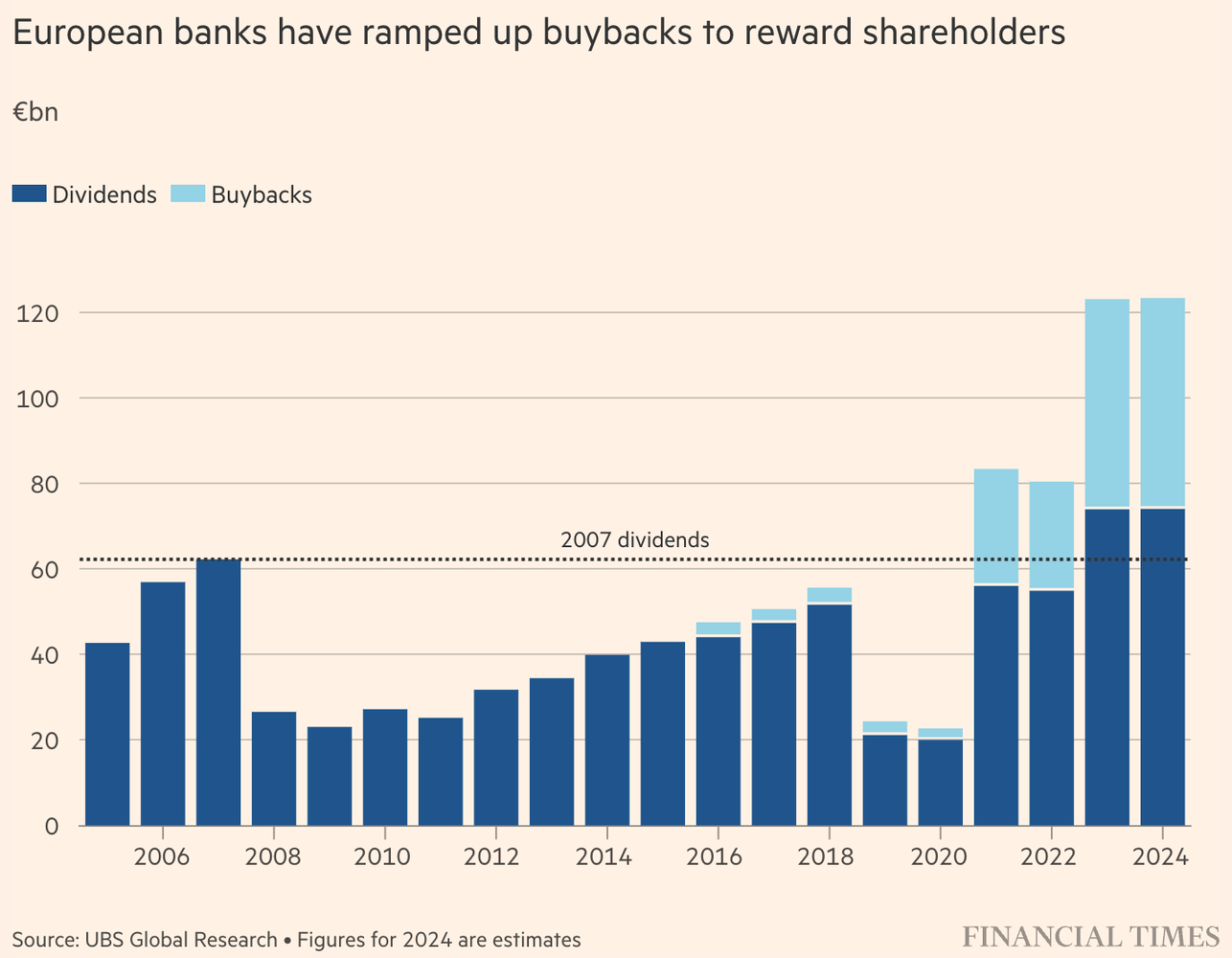

But European banks also attracted media attention. UBS estimates that shareholder compensation for 2024 could exceed $123 billion for the second year in a row. After a long period of low or even negative interest rates, the outlook for banks has improved significantly since the Covid pandemic.

European bank shares are reaching all-time highs thanks to high-interest yields. And although the ECB has already started to cut interest rates, banks still have the opportunity to take advantage of this situation and maximise profits in 2025 thanks to the economic recovery of consumers.

You can see that EU banks have had a good run so far in 2025 as well. Deutsche Bank is leading the way, with Unicredit not far behind. Many others added as much as 10% year-to-date.

Despite the positive developments, however, valuations of European banks still lag behind their US counterparts. Many European titles are trading at less than their book value, suggesting room for growth.

On the other hand, the deregulation of the US banking sector poses a significant competitive risk for European banks. Less stringent rules may allow US banks to expand more aggressively, which could put pressure on European players in international markets.

The luxury sector

With the start of the Q4 2024 earnings season, we were able to get a glimpse into the performance of several leading European players in the luxury goods sector. Brunello Cucinelli, Richemont and Burberry reported results, while we expect further reports in the coming weeks. What trends did these results reveal?Richemont

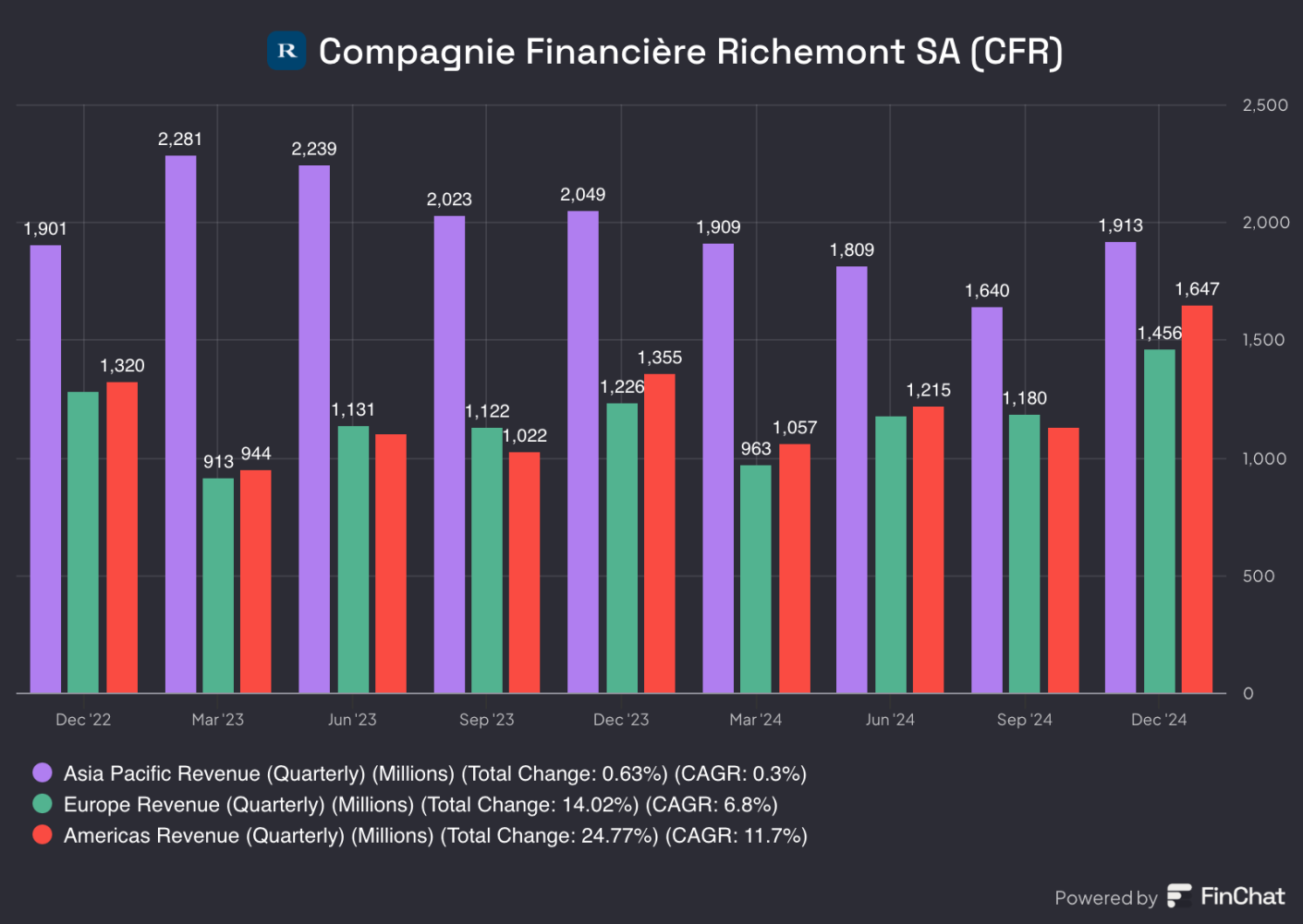

Richemont, known for its luxury jewellery and watches such as Cartier, Piaget and Montblanc, reported double-digit sales growth in all regions except Asia.

In Asia, sales fell 7%, driven by an 18% drop in mainland China. Nevertheless, this is an improvement on the 16-19% year-on-year decline in previous quarters. Asia accounts for up to 40% of Richemont’s sales, making it a key region.

Europe recorded strong growth of 19%, boosted by tourism from the Americas and the Middle East. The Americas grew the most of all regions, driven by strong consumer and economic development. This is a significant acceleration in both regions, as revenue growth in recent quarters was only 5% and 10% respectively.

Brunello Cucinelli

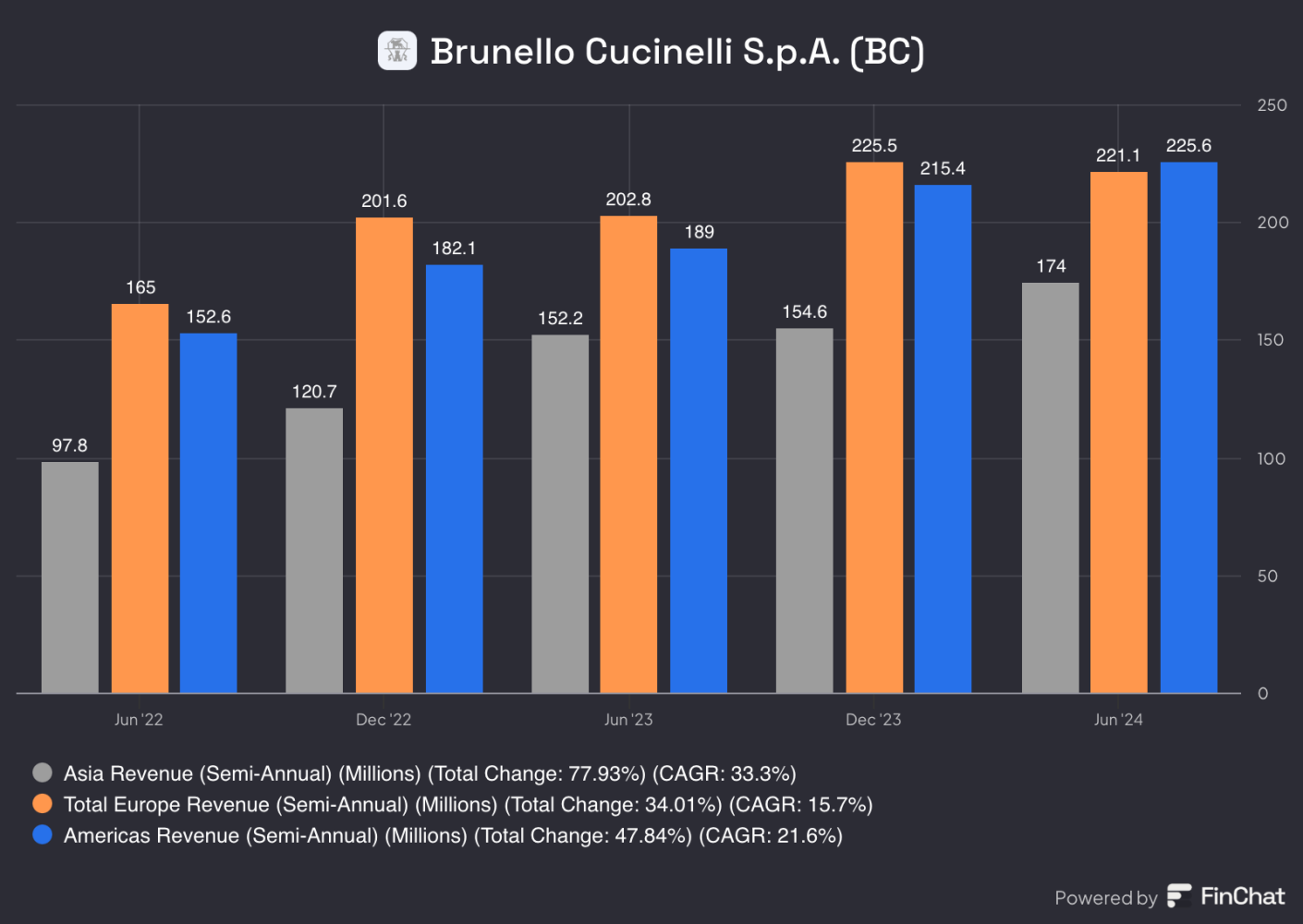

Brunello also reported ” enchanting” Q4 results in January.

In the Americas, sales rose 17.8%, underlining strong demand from US consumers. Europe saw slightly more modest growth at 6.6%.

In Brunello’s case, growth in Asia was surprisingly strong, even after the company raised its expectations to 11-12% growth in December from an initial 10%. Fourth-quarter sales were up 12.6%.

Brunello benefits from a unique position in Asia as it targets ultra-high-net-worth clients that have not been affected by the widespread economic slowdown. Hermes is also in a similar position. Brunello also benefits from the fact that Asia accounts for only ~27% of its sales.

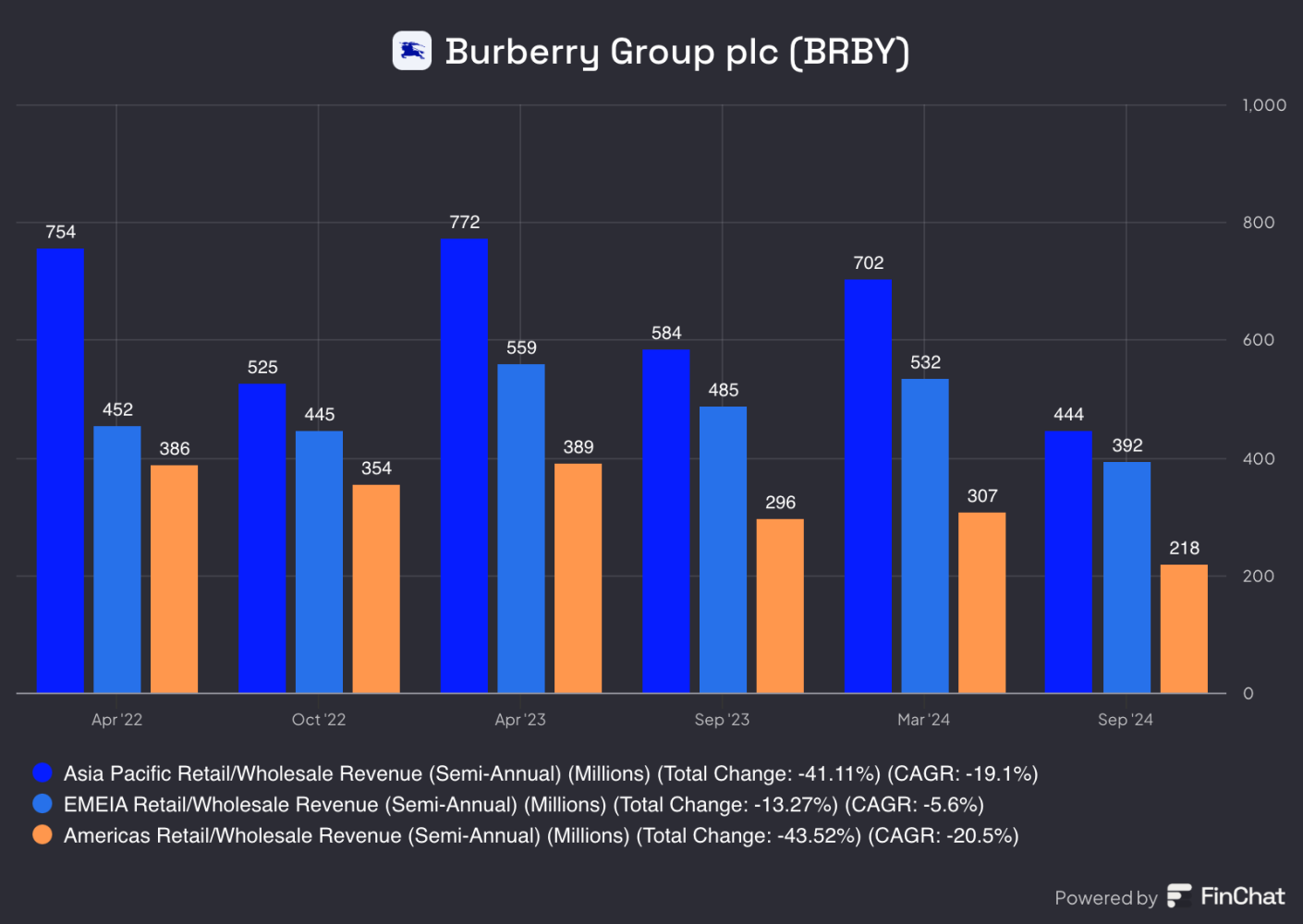

Burberry

Burberry is facing a difficult time given the ongoing efforts to revive the brand. Despite this, sales in the Americas recorded 4% growth. Europe saw a 2% decline, while sales in China unsurprisingly fell the most, down 7%.

However, the results were still better than analysts expected, leading to a massive rally in Burberry shares.

The entire sector rode the wave of optimism from these results, especially the strength in the US and the recovery of European consumers. In the second half of last year, investors lost confidence in some brands given that the uncertain extent of the economic problems in China posed a significant risk to many of them. But it seems that investors were a little too pessimistic.

That has been reflected in their share prices this year, as most have risen 15% and more since the start of 2025. The ones who reported are leading the way, with Richemont adding 24%, Burberry rising 22%, Moncler is close in 3rd place.

Not everything is as rosy as it seems

While the banking and luxury goods sectors in Europe are showing promising developments, other European favourites face significant challenges. The earnings season in Europe may be off to a slower start than in the US, but there are already early signs of risks that could affect 2025.

For example, ASML shares recently weakened after Dutch Prime Minister Dick Schoof hinted at the possibility of renewing strict export bans on AI chips from the USA at a forum in Davos. Such restrictions, similar to those under Joe Biden, could significantly disrupt supply chains and export prospects for European technology firms.

Concerns were also expressed by Ericsson, whose shares fell after its results were published. The company warned of the negative impact of the tariffs, which it said posed a serious threat to Europe’s information and telecoms industry.

Novo Nordisk, one of the darlings of the European market, is not in the clear either. Its shares benefited last year from optimism around obesity drugs, particularly Wegovy and Mounjaro, which were originally developed as diabetes treatments but have proved effective in reducing appetite. However, demand did not match investor expectations. Moreover, the results of clinical trials of the new drug have produced mixed conclusions. Novo Nordisk will not publish its quarterly results until 5 February.

Prices of these stocks have shown some volatility since the start of the year, but settled in the red so far.

And what about Davos?

Last Friday, one of the most important global conferences of the year took place in Davos, Switzerland. The World Economic Forum is a platform that brings together leaders from politics, business, academia, economics and other fields. Every year, more than 3,000 participants gather in this picturesque town in the Swiss Alps to discuss and find solutions to global problems.

This year’s event, entitled “Cooperation for the Intelligent Age”, took place at a pivotal moment for world politics – coinciding with the conclusion of the Gaza ceasefire and the inauguration of the new President of the United States.

What lies ahead for Europe in 2025?

Despite optimism in a few selected areas, Europe’s structural problems remain unchanged. The new year still holds many unknowns. Key areas for investors to focus on include:

- Geopolitical pressures: competition with China and the US, who do not hesitate to resort to unfair practices, may hamper European growth.

- A strong dollar: It continues to push up the price of imports and weaken the euro, raising costs for European firms.

- Energy crisis and regulation: Dependence on energy imports and regulation may remain key factors affecting European corporations.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.