That’s the key question surrounding Teleperformance ($TEP.PA), the French company specializing in outsourced customer service. With a next twelve-month valuation of 5x P/E, market sentiment suggests that AI is poised to replace human customer service representatives. From chatbots providing instant responses to AI-driven analytics predicting customer needs, AI has become an integral part of modern customer service operations. But what if AI and human agents could integrate to create a more efficient and powerful service model? That’s what we’re evaluating here.

Source: TP integrated report 2024.

Key Highlights

- Contract Loss Impact: The non-renewal of a visa application management contract significantly affected Teleperformance’s stock price.

- Recent Acquisitions & Growth Strategy: The acquisitions of Majorel and ZP underscore the company’s commitment to diversification and expansion in digital services.

- Valuation: Trading at 5x Forward P/E, Teleperformance remains attractively valued relative to its sector, and on an absolute basis.

📌 “Never underestimate the value of being there.” – Teleperformance

Business Overview

Founded in 1978 by Daniel Julien in Paris, Teleperformance started as a small call center and has grown into a global leader in customer experience management, operating in 100 countries across Europe, Asia, Africa, and the Americas. The company’s current strategy focuses on integrating AI with human expertise to deliver comprehensive customer service solutions.

Core Business Segments

1. Core Services & D.I.B.S. (Digital Integrated Business Services)

- Customer care & technical support (voice and non-voice)

- Content moderation & Trust & Safety services

- Customer acquisition & loyalty management

- Digital marketing solutions

- Integrated back/middle/front-office services

- Operations consulting, digital expertise, and cloud integration

2. Specialized Services

- Online interpreting (LanguageLine Solutions)

- Visa processing (TLScontact)

- Accounts receivable management (AllianceOne)

- Online healthcare navigation & support (Health Advocate)

- Recruitment process outsourcing (PSG Global Solutions)

Teleperformance has aggressively expanded through acquisitions, notably Majorel (November 2023), strengthening its digital solutions in cloud-based transformation and marketing platforms. The new acquisition of ZP for an amount of $490m, a leader in communication services for the deaf and hard of hearing (English & Spanish), demonstrates the company’s commitment to diversification and inclusion, further expanding its service network.

ESG Challenges and Recovery

After a series of controversies regarding poor working conditions in the Americas, Teleperformance’s stock price fell by 38% in November 2022. Many funds divested due to ESG concerns. This event significantly impacted the company’s reputation.

In response, TP has worked to regain trust by reaching agreements with major labor unions and improving working conditions. As of 2024, it is ranked 7th in the “World’s Best Places to Work” by Bestplacetowork.com and highly rated on Comparably, Indeed, and Glassdoor.

Competitive Advantage

Teleperformance’s ability to serve multinational corporations and governments highlights the importance of scale in outsourced customer service, a single provider with global reach is often preferred over multiple regional providers.

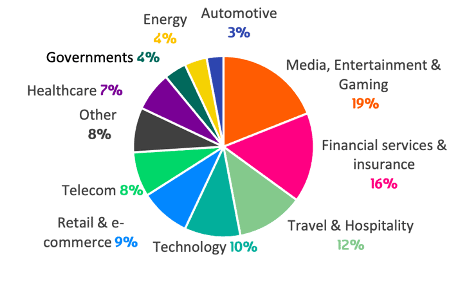

In the chart below, we can see the clients diversification in the core services, and specialized services.

Source: TP presentation 2025.

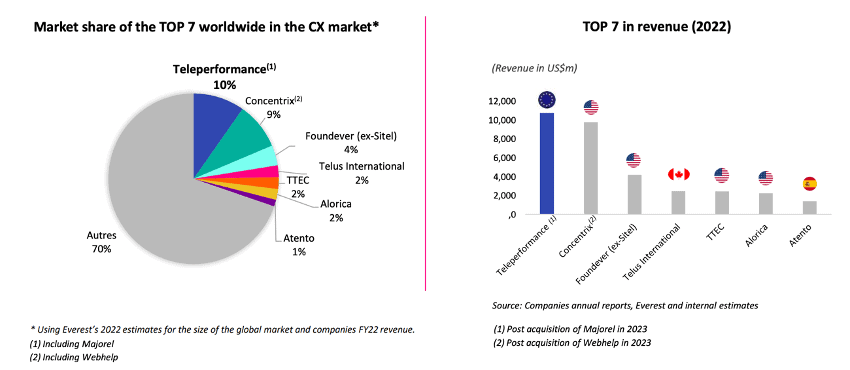

Competitors

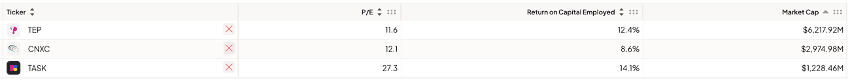

Teleperformance is the #1 company in Business Process Outsourcing (BPO). Due to its wide range of services, direct comparisons with other firms are difficult. However, this analysis focuses on Concentrix as a key competitor.

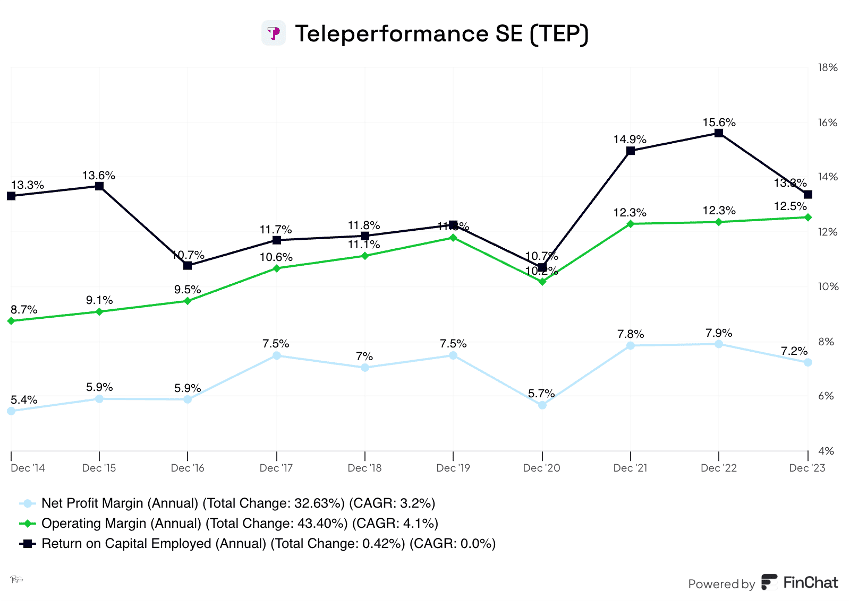

Source: Finchat

Post-2022, following the pandemic-driven surge in customer service demand, the industry has seen a decline in margins due to high outsourcing setup costs. However, TP maintained a 5% net profit margin in 2024, while Concentrix’s margins declined to 2%. Analysts at JP Morgan and White Falcon project growth in the BPO & customer service industry in 2025 and 2026.

Source: TP presentation January 2025.

Investment Thesis

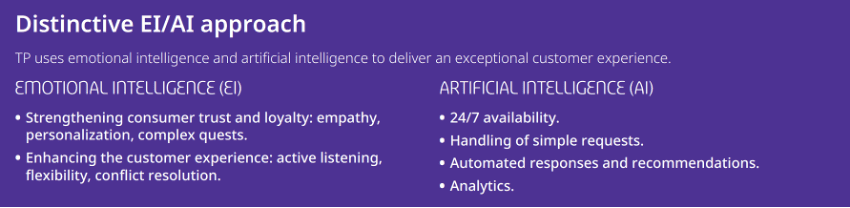

The biggest question surrounding TP is: Can it survive in the long run? This question is not only relevant for tech companies but also for various industries adapting to AI-driven transformation. AI innovation is evolving rapidly, but it is not a new technology, it has existed for over five years. The key difference now is its accessibility to businesses and consumers.

However, TP is not just a call center; it provides a wide range of specialized services that can be enhanced but not fully replaced by AI. While AI can automate basic queries, complex customer issues still require human intervention for critical thinking, empathy, and problem-solving.

Source: TP integrated report 2024.

With double-digit returns on capital employed over the last decade, operating margins between 8% and 12.5%, and net margins ranging from 5% to 7%, we have modeled three potential scenarios for TP’s future.

Source: Finchat.

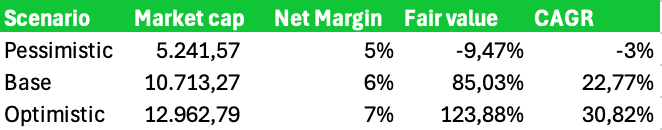

Here are the numbers we must consider:

In our pessimistic scenario, I took into account that the market considers the company is going to decrease their revenue in 3 years a 30%, because their blue-chip customers long term contracts are until 2028. But the margins of the company will still be the same, 5% because their business model, where costs are generated mostly by hourly rates of the employees, in the case of don’t having contracts, they don’t have those cost.

That’s why in our estimations, in the worst-case scenario where they loses 30% of their revenue, they kept the net margin in 5%. So, if the future is any better than losing 30% of its revenue, the company should deliver a positive return.

In the base scenario, we considered a small growth, less than the guidance of the company, and we kept margins in line with their historical margins, of 6%. Which show us a Compound Annual Growth Rate of 22%

In the optimistic scenario, we maintain the margins in line and the growth of the revenue in line with the guidance of the company, and we obtained a CAGR of the 30% and a +123% on our investments.

Financial Strength

TP has strong access to liquidity, demonstrated by the issuance of €500M in bonds at a 4% coupon rate, with an investment-grade rating (BBB) from S&P—the highest credit rating in the customer experience management industry (Financial Times).

For comparison, U.S. Treasury bonds currently yield ~4.5%, indicating that the debt market has confidence in TP’s ability to meet its obligations. However, the stock market remains skeptical of its long-term potential.

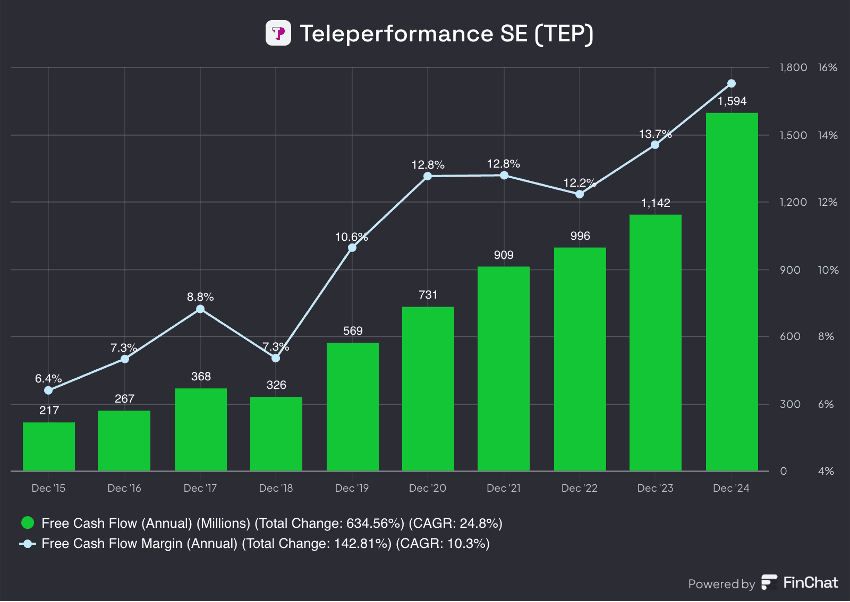

Source: finchat.

Risk Factors

- AI Disruption Concerns: A HubSpot survey found that 72% of industry leaders believe AI can outperform human agents by delivering faster, more consistent responses while operating 24/7. This could pressure TP to lower prices, impacting margins and/or revenues.

- Currency Fluctuations: TP operates in inflationary economies such as Brazil, Argentina, Egypt, and Turkey, exposing it to currency risks. However, some risks are offset by favorable exchange rates in other markets.

- Financial Debt: Net debt stands at €3.89B, with a Debt-to-Equity ratio of 1.1 relatively low compared to industry peers. Strong free cash flow (FCF) generation supports the company’s ability to meet its obligations.

Final Thoughts

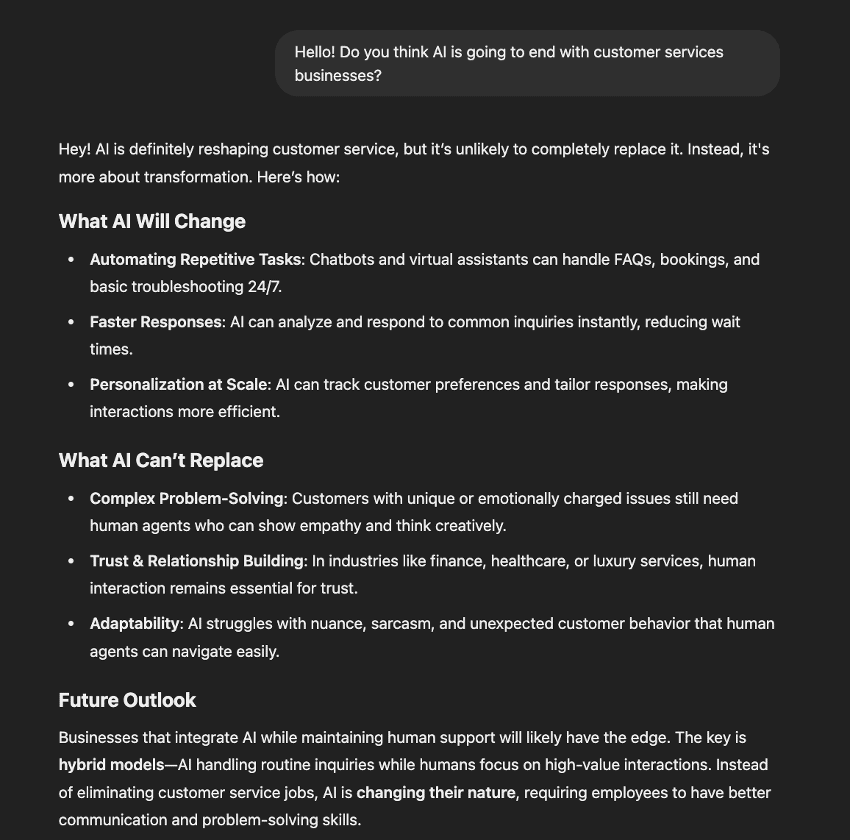

What could be better than asking AI if AI is going to replace customer services businesses.

Source: Openai.chatgpt.

Teleperformance sits at a crucial intersection of AI innovation and human-driven service, but the company offers a wide variety of services, and the more the World changes to a more digital era, the more the services given by TP will be needed. AI is trustworthy and efficient, but customer services, online moderation, AI training, visa outsourcing, and the rest of the services TP gives, are just going to be fusionated with AI to improve efficiency, costs, and time. The current scale of TP creates a barrier to entry to new players, and switching costs, and the insourcing of these services implies high investments.

🚀 AI is poised to change the landscape of customer service. Do you think it will enhance or completely replace human involvement? Share your thoughts!

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.