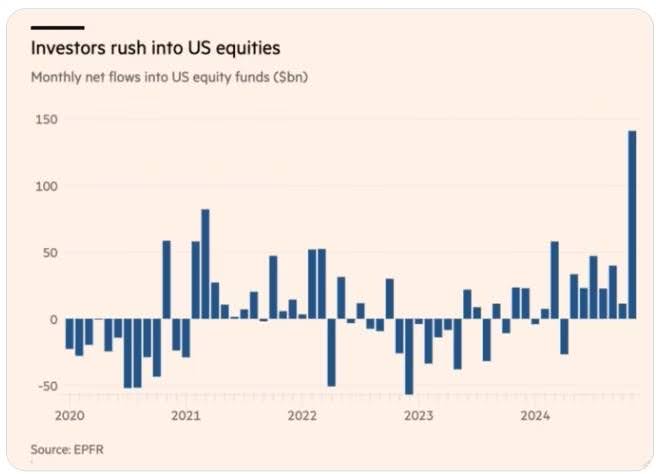

The end of 2024 is marked by a strong attraction to US stock markets, particularly through S&P 500 and MSCI World ETFs. While we cannot yet speak of a speculative bubble in the strict sense, several indicators suggest irrational exuberance and the need for increased caution. The current state of the US stock market, characterized by high valuations and a concentration of gains on a limited number of companies, raises concerns about its sustainability.

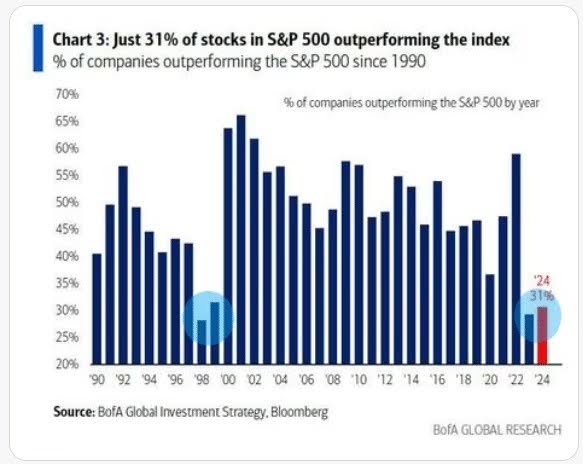

A Worrying Concentration of Gains

One of the most significant warning signs lies in the concentration of performance on a small number of companies. In 2024, only 31% of the companies comprising the S&P 500 index outperformed the index itself. This is the third-lowest figure recorded in the last 50 years. This situation is eerily reminiscent of the years preceding the bursting of the dot-com bubble, where a handful of technology stocks drove the entire market. This concentration of gains makes the index particularly vulnerable to a reversal of fortune for these few companies. If these leaders were to experience difficulties, the impact on the entire market could be considerable.

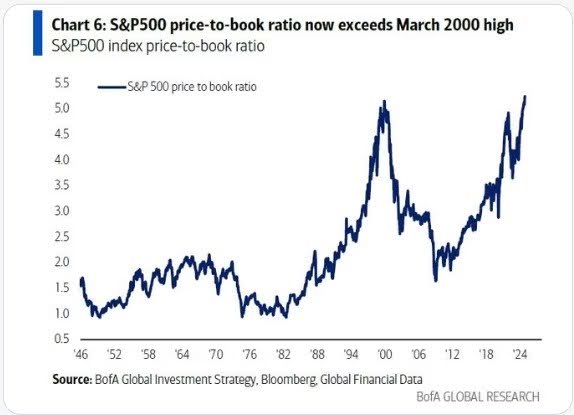

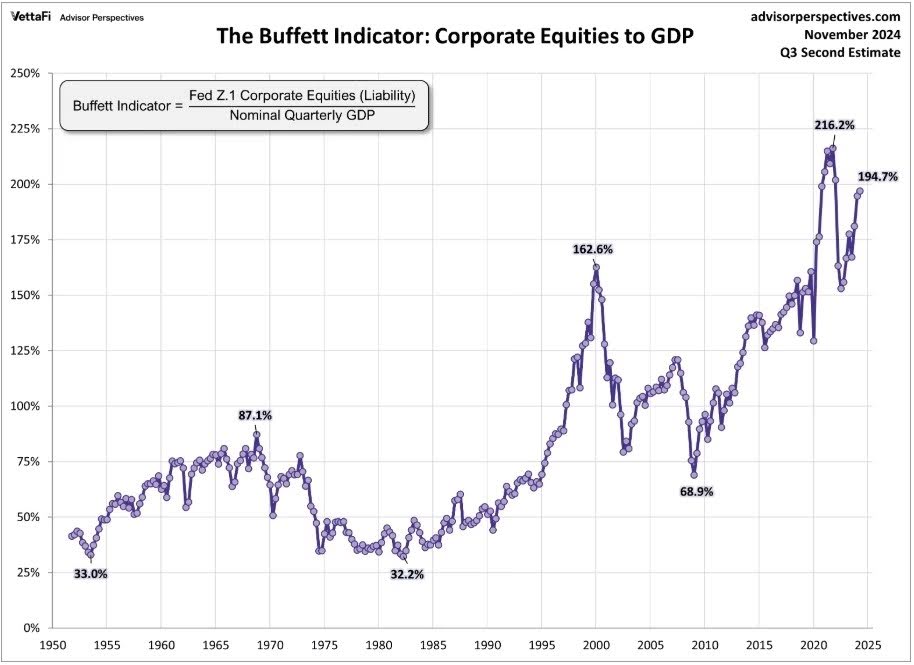

Valuations at Historic Highs

Alongside this concentration of gains, valuations of US companies are reaching historically high levels.

Several indicators, including the famous Warren Buffett indicator, attest to this situation. The Buffett indicator, which compares total market capitalization to GDP, is considered by the legendary investor as “probably the best single measure of where valuations stand at any given moment.” A high ratio suggests an overvaluation of the stock market. Current levels of this indicator reflect excessive investor confidence and a possible disconnect between asset prices and economic reality.

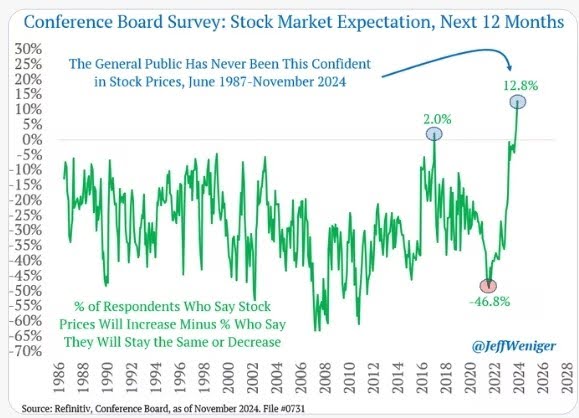

The Euphoria of US Investors

The morale of US investors is reaching peaks. Surveys from the Conference Board reveal an optimism rarely observed since the creation of this statistic in 1987. This ambient euphoria, while understandable given past performance, is a risk factor in itself. A sense of overconfidence can lead to irrational decision-making and fuel a speculative bubble. When market sentiment reverses, the correction could be brutal.

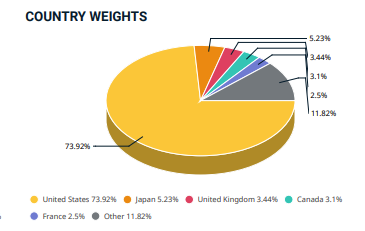

The Excessive Weighting of the United States in the MSCI World

The weighting of the United States in the MSCI World index is reaching record levels, reflecting the current dominance of the US market. This overrepresentation of US equities in an index intended to represent the global economy raises questions about its real diversification. Such geographical concentration exposes investors to increased risk in the event of economic difficulties specific to the United States.

Lessons from the Past and Future Prospects

The history of financial markets is punctuated by cycles of expansion and contraction. The adage “trees don’t grow to the sky” reminds us that every period of growth eventually runs out of steam. Past performance, however brilliant, is no guarantee of future performance. It is therefore crucial not to succumb to euphoria and to prepare for a possible slowdown, or even a correction, of the market.

Statistics suggest that future performance of the S&P 500, and therefore the MSCI World, may be disappointing in the coming years. Several scenarios are possible. A stock market crash cannot be ruled out, although it is difficult to predict with certainty. A more moderate correction, bringing valuations back to more reasonable levels, is also possible. A long sectoral rotation, where currently overvalued companies experience a period of stagnation or decline, while other sectors struggle to compensate, is another hypothesis.

Caution and Diversification

In the face of these uncertainties, caution is advised. It is important to diversify investments and not to focus solely on S&P 500 and MSCI World ETFs. Investing in other asset classes, such as bonds, real estate, or commodities, can help reduce overall portfolio risk.

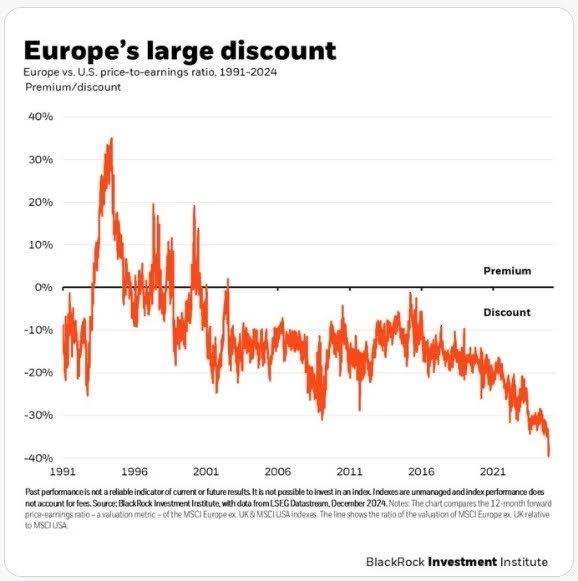

It is also important to note that, alongside the overvaluation of US stocks, valuations of European stocks appear relatively low. This could be an interesting investment opportunity for investors seeking geographical diversification.

In conclusion, while the attraction to S&P 500 and MSCI World ETFs is understandable given past performance, several indicators suggest irrational exuberance and a growing risk. It is crucial to remain vigilant, diversify investments, and prepare for a possible market correction. Caution is advised to navigate safely in the potentially turbulent waters of the financial markets.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.